Brazil 06/07 Rice Update and trip Report

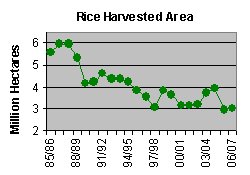

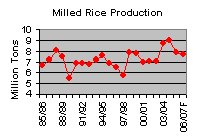

Overall, the weather has been good to very good for Brazil’s 06/07 rice crop and an above average yield of 3.76 tons per hectare (for unmilled rice) is expected. Harvest is underway in the southern states. Harvest will begin in April in the Center-West followed by harvest in the Northeast. USDA’s March 2006/07 milled rice production estimate is unchanged at 7.7 million tons (or 11.3 million tons of rough production assuming a 0.68 milling rate). Brazil’s harvested rice area is forecast at 3.0 million hectares, which is unchanged from last month and nearly the same as last year, however this year’s area estimate is significantly lower than rice area in the years prior to 05/06. Analysts from the Foreign Agricultural Service traveled in the rice areas of Brazil from January 16 - 26. Many facts and opinions in this report were obtained from interviews and observations made during this trip.

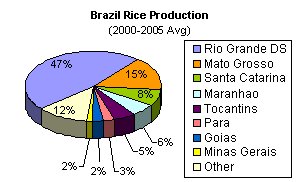

There are two main – and very different - areas of rice production in Brazil: the older, well-established irrigated areas of the South, and the newer non-irrigated (i.e. “upland”) areas of the Center-West and Northeast. The main producing states that comprise Brazil’s southern rice area are Rio Grande do Sul (RS) and Santa Catarina (SC), which produce approximately 47 and 8 percent of the country’s total rice production, respectively. While Rio Grande do Sul is the biggest producing state in Brazil, the second largest producing state in Brazil, Mato Grosso (MT) in the Center-West, accounts for 15 percent of the total rice production. In Mato Grosso and in the other rice-growing states of the Center-West, namely Goias, and in the Northeast, namely Maranhao, Tocantins, and Para, rice is grown in very large, newly cleared fields and is used to prepare the soil bed for soybeans and cotton. Only 20 to 30 percent of the rice production in Mato Grosso is on land that will continue to produce rice. In these cases, rice is more of a rotation crop for soy such that producers insert rice into the soy rotation to interrupt pest cycles.

Unlike the rice area of the Center-West and Northeast, the rice area in the South is more stable. Rice farmers in the South have significant investments in rice irrigation infrastructure making the switch to other crops less likely. Rice farmers typically grow soybeans every 4th or 5th year (after 3 to 4 years of rice) as a way to control weeds, particularly red rice. Clearfied rice, tolerant of imidazolinone herbicides such as Scepter and Pursuit, is also widely planted to control red rice. Because rice in the South is heavily irrigated, lime application every year is necessary to counterbalance the iron-rich soils. While rice is a major crop in RS, it is still second in area to soybeans. Rice is likely to be more profitable this year in the South yet soybeans are more liquid (i.e. soybeans can be sold very quickly and payment is received by the farmers in a few days).

Above left photo: irrigated rice field in RS. Right photo: irrigation reservoir in RS.

While southern rice areas have remained relatively stable, new upland rice areas had witnessed large decreases in area in 05/06 compared with the three previous years. In 2003 through 2005, before severe problems with Asian soybean rust and an unstable exchange rate, Brazil’s Center-West and Northeast had witnessed an energetic soybean expansion. This resulted in plentiful newly cleared areas which are normally planted to rice for one or two years before they are transitioned into soybeans. In 06/07 rice area increased 7 percent in Mato Grosso compared with 05/06; however, rice area in the state is still less than half of what it was in 04/05. An important reason for this decrease was low soybean and cotton prices, which stretched producers’ credit and halted the expansion of new area in Mato Grosso, Roraima, and Maranhao. In addition to poor commodity prices in 04/05, rice prices at the time of the 05/06 rice planting season were only half of what they were the previous year. Poor prices forced many producers to plant rice for one year as opposed to two on the newly cleared land before planting soybeans. As a result, area fell drastically in the expansion areas compared to 04/05, with a 60 percent decrease in Mato Grosso, a 47 percent decrease in Tocantins, and a 29 percent decrease in Para.

The cost of production of rice in RS is between 20 and 28 Reals per 50-kg bag, which includes irrigation and land cost. For farmers who own their own land, their cost of production is on the low end of this range. In the Northeast, specifically in Tocantins and Maranhao, it is cheaper for farmers to produce rice than it is for rice farmers in the South, mostly because there is no irrigation and land is cheaper. The price of a 50-kg bag of rice in Rio Grande do Sul during planting season was 35 Reals per bag last year. It went down to 14 Reals per 50-kg bag in March 2006 (during harvest); this, of course, caused financial difficulties for farmers. In October, 2006 rice was approximately $R25-26 per 50kg and in February 2007 it fell to $R21-22 per 50kg in Rio Grande do Sul according to the Syndicate of the Rice Industry in Pelotas.

While total rice area in Brazil has decreased over the past 20 years, continual increases in yield have allowed production to remain relatively stable (see above graphs). Rice yields have steadily increased over the last 20 years due to improved technology (e.g. seed varieties, management practices, increased irrigation). However, consumption of rice in Brazil is generally decreasing as people eat more poultry and pork, as well as beef. Rice companies are developing new markets – such as parboiled rice – which they are marketing as a healthier choice of rice. Parboiled rice consumption is expected to continue to increase in the upcoming years, especially in wealthier urban areas, yet overall rice consumption will likely continue to decrease. Ten years ago parboiled rice consumption was approximately 7 to 10 percent of total rice consumption and now it accounts for roughly 20 percent.

About 99 percent of the rice grown in Brazil is thin long rice and about 1 percent is short. The quality of rice grown in southern Brazil is very high while the upland rice grown in the Center-West is of lower quality. The markets for high quality rice are mainly in southern Brazil and around the large urban areas of Sao Paulo and Rio de Janeiro. The lower quality rice is sold in the Northeast of Brazil, where the population is poorer. Broken rice is largely exported to Africa. Depending on the size of the Argentine and Uruguayan rice crops, in addition to this year’s Brazilian crop, there is a possibility that there will not be enough production of high quality rice to meet Brazilian demand this year; the possibility of importing from the U.S., however, is complicated. It will be difficult to import rice from the US because of quality issues and controversy over genetically modified (GM) varieties, which Brazil importers do not want. Nonetheless Brazil’s stocks have been continually decreasing over the last few years. The last time rice was imported from the U.S. was 2002/03 when there was a lack of rice in the Mercosul countries, namely Argentina, Uruguay, and Paraguay.

The rice varieties used in RS are from Brazilian companies and  largely from the Rio Grande do Sul Institute of Rice (IRGA), which has its headquarters in Porto Alegre. Approximately 60 percent of the rice varieties used by Brazilian farmers have been developed by IRGA (The variety “IRGA 4220” is widely planted). In the past, American and Japanese varieties were grown. According to a spokesman at Jonsapar, the largest rice company in South America, Brazilian consumers do not like the quality of these varieties and the Brazilian rice millers don’t like the milling attributes of these varieties; thus, most of the varieties grown in Brazil were developed in the country (from IRGA or other Brazilian seed companies). Another major advantage of using Brazilian rice varieties is that they have been developed for the various specific local climates within Brazil. largely from the Rio Grande do Sul Institute of Rice (IRGA), which has its headquarters in Porto Alegre. Approximately 60 percent of the rice varieties used by Brazilian farmers have been developed by IRGA (The variety “IRGA 4220” is widely planted). In the past, American and Japanese varieties were grown. According to a spokesman at Jonsapar, the largest rice company in South America, Brazilian consumers do not like the quality of these varieties and the Brazilian rice millers don’t like the milling attributes of these varieties; thus, most of the varieties grown in Brazil were developed in the country (from IRGA or other Brazilian seed companies). Another major advantage of using Brazilian rice varieties is that they have been developed for the various specific local climates within Brazil.

IRGA has been largely responsible for the adoption of technology by rice farmers in Brazil, and thus the steady increase in rice yields. IRGA charges a small tax per bag of seed to maintain their research endeavors. IRGA has the goal of reaching an average yield in Rio Grande do Sul of 10 tons per hectare by 2010 via its Project 10. This project is a research endeavor that uses traditional plant breeding methods (not genetic engineering) to develop higher yielding rice varieties that would also have other beneficial attributes (e.g. drought tolerance, cold tolerance, higher milling quality, reduced fertilizer requirements). Minimum and no tillage practices are increasingly adopted, which are helping to increase yields.

Fertilization rates for rice are typically 300-350 kg/ha in the South and urea is the typical fertilizer. In addition to nitrogen, potassium and phosphorus are also needed to grow rice in southern Brazil. Brazil, however, doesn’t have its own phosphorus reserves, so phosphorus along with other inputs to make fertilizer are imported from Russia, Romania, Germany, and the US.

Rains in Rio Grande do Sul have been generally good, yet variable at times, throughout most of the growing season. While rice is irrigated in RS, water continues to remain the limiting factor to production in the majority of areas within the state. For this year, however, water has been adequate in most of the major rice areas. Rains have been good to abundant in the Center-West and Northeast such that strong rice yields are expected.

Current USDA area and production estimates for grains and other agricultural commodities are available on PECAD's Agricultural Production page or at PSD Online.

|