Ukraine: Grain Production Prospects for 2008/09

Analysts from the USDA Foreign Agricultural Service in Washington and the office of the U.S. agricultural attaché in Kiev conducted April crop-assessment travel in central, eastern, and southern Ukraine to assess 2008/09 crop production prospects and related issues. The team met with agricultural officials, independent commodity analysts, and directors of agricultural enterprises who provided extensive information on a variety of key issues:

- Current conditions for winter crops (chiefly wheat and rapeseed) and early spring grains (chiefly barley) are very good. Wheat production for 2008/09 is forecast to increase by over 6 million tons over last year, and barley by 4 million.

- Although official statistics suggest that 5 million hectares of formerly productive agricultural land currently lies idle, only a small portion of this area is likely to be returned to crop production in the near future.

- Record or near-record commodity prices, combined with expanding outside investment in agriculture, are supporting continued growth of intensive technology to boost yield and reduce operating costs. At the same time, however, many financially strapped farms are forced to rely on outdated technology and aging machinery.

- Higher prices for fuel and other inputs will boost the cost of production for most crops by 20 to 40 percent over last year’s level. Commodity prices, meanwhile, have increased at an even greater rate over the past year and currently stand at record or near-record levels.

Crop Conditions and Production Estimates

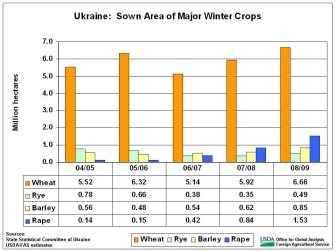

The sown area for 2008/09 Ukraine winter grains area increased by 16 percent from last season. Winter wheat was sown on 6.7 million hectares (against 5.9 million in 2007/08), winter barley on 0.85 (0.62) million, and rye on 0.49 (0.35) million. Meanwhile, winter rape area continued to grow at an astonishing pace: sown area for 2008/09 jumped to 1.53 million hectares, against 0.84 million last year and 0.15 million only three years ago. Winter rape accounted for 85 percent of Ukraine’s total rape area in 2007/08.

The team observed very good conditions for winter crops throughout central, eastern, and southern Ukraine. The crops were well established prior to entering dormancy and winterkill was relatively low. Preliminary estimates from the Hydromet Center of Ukraine and the State Statistical Committee both estimate winter losses below 5 percent against the ten-year average of 8 percent (excluding the disastrous 2003/04 crop which suffered winter-grain losses approaching 70 percent). Warm February weather enabled crops to break dormancy earlier than usual, but temperatures stabilized in March and development slowed. As of mid-April, winter wheat had reached the stem-elongation stage throughout the main production region, about the same stage of development as last year and two to three weeks ahead of normal. The team observed very good conditions for winter crops throughout central, eastern, and southern Ukraine. The crops were well established prior to entering dormancy and winterkill was relatively low. Preliminary estimates from the Hydromet Center of Ukraine and the State Statistical Committee both estimate winter losses below 5 percent against the ten-year average of 8 percent (excluding the disastrous 2003/04 crop which suffered winter-grain losses approaching 70 percent). Warm February weather enabled crops to break dormancy earlier than usual, but temperatures stabilized in March and development slowed. As of mid-April, winter wheat had reached the stem-elongation stage throughout the main production region, about the same stage of development as last year and two to three weeks ahead of normal.

Although soil-moisture reserves in central and eastern Ukraine still have not been fully replenished following last year’s excessive dryness, soil moisture is adequate and both winter and spring crops have benefited from favorable April and early-May rainfall. The farm directors interviewed by the team all expect high yields provided the crops receive “a couple of good rains” in May. Based on the increase in planted area, low winter losses, and favorable early-season conditions, the USDA estimates Ukraine wheat production for 2008/09 at 20.0 million tons, up 6.1 million from last year. Winter wheat accounts for about 95 percent of total wheat output. Total wheat area is estimated at 6.8 million hectares, against 6.0 million last year, and yield is forecast to increase from 2.34 to 2.94 tons per hectare.

Spring-barley planting was completed in a timely fashion, and the Ministry of Agriculture reports sown area at 3.44 million hectares, slightly lower than earlier forecasts of 3.52 million and down 1.0 million from last year. Several factors contributed to the year-to-year reduction in spring barley area:

- The increase in winter grain area, which typically results in lower spring barley area;

- Low winterkill. Barley is the chief grain used for spring reseeding of damaged or destroyed winter-crop fields.

- The current high level of barley stocks and farmers’ wariness about the possibility of a third year of export restrictions.

- The higher profitability and greater demand for corn and sunflowerseed.

The USDA estimates total barley production for 2008/09 (winter and spring) at 10.0 million tons, up 4.0 million from last year, and harvested area at 4.2 million hectares. As with wheat, the yield for barley is forecast to rebound from last year’s drought-reduced level, from 1.46 to 2.16 tons per hectare.

The planting of corn and sunflowers was roughly half complete by the end of April. Corn had been planted on 0.89 million hectares (against the Ministry of Agriculture forecasts of 2.34 million) and sunflowers on 1.78 (3.23) million hectares. Despite the skyrocketing prices for both crops, the increase in winter crop area combined with the constraint on the amount of agricultural land suitable for planting will restrict the growth of spring crop area. Preliminary forecasts from the country’s major commodity analysts indicate that spring-crop area is unlikely to increase by more than 0.5 million hectares – and probably less – from last year. All are forecasting larger year-to-year area increases for sunflowers than for corn. Even a relatively small increase in spring crop area, however, on top of the 1.8-million-hectare increase in the sown area of winter wheat and rape, would boost total grain and oilseed area to an all-time high. (Note that this does not imply a record-high total planted area for all crops. The planted area of forage crops, for example, has been declining steadily and significantly, from nearly 11 million hectares in 1995 to less than 3 million in 2007 – an average decrease of 0.6 million hectares per year.)

The USDA estimates 2008/09 corn production at 8.0 million tons, against 7.4 million last year, and harvested area at 1.9 million hectares, matching last year’s level. Yield is forecast at a near-record 4.21 tons per hectare, based on the expanded use of hybrid planting seed and the assumption of average weather during the remainder of the growing season. (Initial estimates for sunflowerseed and other oilseeds will be released on June 10.)

Cost of Production and Crop Profitability

Higher prices for fuel, fertilizers, chemicals – in short, everything – will boost the cost of production for most crops by 20 to 40 over last year’s level. The cost of production (COP) for wheat and other crops varies depending on yield targets and the level of technology used to produce the crop. Most farm directors and commodity analysts that the team interviewed estimated the cost of production for wheat between $120 and $360 per hectare. Typically, the per-hectare COP for rapeseed is a little higher than for wheat, because of high seed and fertilizer costs, and a little lower for sunseed than for wheat due to typically lower fertilizer use.

The government offered essentially the same direct crop-production subsidies this year as last year: approximately $20 per hectare for wheat, $16 for soybeans, $10 for rapeseed, and $11 for winter barley. No direct subsidies were offered for spring barley, corn, or sunflowers. Farms can also receive a $12-per-ton subsidy for purchases of plant protection chemicals and mineral fertilizers. In addition, the State subsidizes 11 to 14 percent of the interest on commercial loans. Current interest rates typically range between 18 and 22 percent. About 90 percent of Ukraine’s farms qualify to receive commercial credit, but the combination of 20-percent interest and, in some cases, crop-insurance requirements can make the cost of borrowing money prohibitively high. Most of the profitable agricultural enterprises take advantage of the direct subsidies and the interest subsidy, although directors routinely complain about cumbersome bureaucratic obstacles and delays in reimbursement.

Only a small portion of Ukraine’s crop area – estimates range from 2 to 7 percent – is insured. The cost of insurance is relatively high: 15 to 20 percent of the projected income from the insured field. Furthermore, farmers express a high level of distrust for Ukrainian insurance companies and argue that the companies have a reputation for not making good on legitimate claims. In 2003, for example, when persistent ice crusting destroyed about 65 percent of Ukraine’s winter grains, farmers were reimbursed for only 8 percent of the insured fields because insurance companies maintained that the crops perished from suffocation rather than direct frost damage. Most farm directors feel that the money spent on crop-insurance premiums is better spent on high-quality planting seed and other inputs.

Domestic prices for most major commodites have increased even more sharply than the estimated costs of production. Prices for wheat have increased by roughly 60 percent since last May, corn by 40 percent,  barley by 30 percent, and sunflowerseed by 200 percent. These increases have occurred despite export quotas (essentially export bans) on wheat, barley, and corn that were imposed by the government in November 2007, ostensibly to ensure adequate supplies of grain for the domestic market and to guard against skyrocketing food prices. barley by 30 percent, and sunflowerseed by 200 percent. These increases have occurred despite export quotas (essentially export bans) on wheat, barley, and corn that were imposed by the government in November 2007, ostensibly to ensure adequate supplies of grain for the domestic market and to guard against skyrocketing food prices.

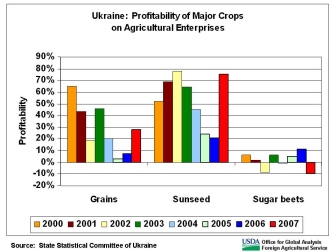

Sunflowerseed has for years been one of the most consistently profitable crops in Ukraine. According to the State Statistical Committee of Ukraine, sunflowerseed profitability has averaged 54 percent for the past eight years and reached a near-record 75 percent in 2007. At the moment, however, most farm directors and commodity analysts cite rapeseed as the country’s most profitable crop (high production costs notwithstanding), followed by sunflowerseed and wheat

The Role of Investors

The 1990’s were lean years for Ukrainian agriculture. After the breakup of the Soviet Union, State and collective farms were liquidated and the land and other assets of the farms were distributed among the farm workers and their families in the form of shares. In most cases, the shareholders chose to lease their shares back to a newly-formed joint-stock associations or cooperatives in exchange for a modest annual payment in the form of cash or produce. Faced with the sudden loss of massive State subsidies, agricultural enterprises struggled with crippling cash shortages and crop yields plunged.

Beginning around 2000, investors became increasingly interested in agriculture. Some investors were large agricultural companies looking to secure grains for export or sunflowerseed for their oilseed crushing plants. Others were largely non-agricultural companies that viewed agriculture as a venture with high potential profitability. The farms benefited as well, because the investors provided much-needed operating capital and market expertise in exchange for a share of the profits. In the case of an outside investor, the investor typically retained the director and staff of the existing farm to oversee the day-to-day operations and to serve as the liaison between the investor and the shareholders. Although land can be leased for as long as 49 years, investors typically rent land from the shareholders through three-, five-, or ten-year leases. Annual lease payments range widely, from $30 to $150 per hectare per year.

At the moment, about 90 percent of the agricultural enterprises in Ukraine are aligned with investors. Not all investors are large companies. Some began as directors of post-Soviet cooperatives and joint-stock associations, and some were private farmers (shareholders themselves) who continually expanded their enterprises by leasing additional plots from other shareholders, and through solid management were able to build successful and consistently profitable enterprises. Of the 90 percent of investor-supported enterprises, roughly 75 percent are private farms (note that even small private farms can attract investors), and 15 percent are large agricultural holdings greater than 50,000 hectares in size.

The operating capital provided by investors (and the profits earned by well-managed private farms) has fueled a modest but steady improvement in agricultural technology, although many farms still do not use intensive technology and average wheat yields in Ukraine remain lower than during Soviet times. Furthermore, there remains a sharp disparity between yields reported by small farms and the significantly higher yields achieved on larger and more affluent enterprises. This yield gap can be attributed directly to a difference in the level of technology, which in most cases is a  reflection of farm management. As unprofitable and poorly managed farms are absorbed by more efficient enterprises (as has been occurring in recent years), overall agricultural performance will continue to gradually improve. reflection of farm management. As unprofitable and poorly managed farms are absorbed by more efficient enterprises (as has been occurring in recent years), overall agricultural performance will continue to gradually improve.

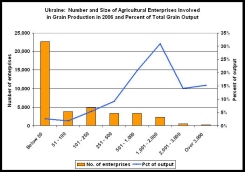

According to the State Statistical Committee of Ukraine, there were about 41,200 agricultural enterprises involved in grain production in 2006. Over half are below 50 hectares in size, but these enterprises account for a combined total of only 4 percent of total 2006 grain production in Ukraine. Fewer than 300 enterprises, less than 1 percent, are larger than 3,000 hectares and they produced 15 percent of the country's grain, while over half of the grain crop was produced on enterprises with area between 500 and 2,000 hectares.

Idle Land

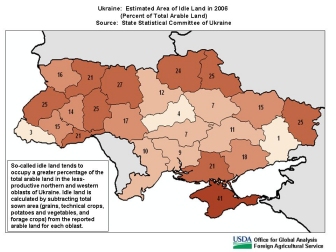

One of the frequently-raised questions regarding Ukrainian agriculture concerns the amount of arable land that is not being utilized for crop production – so-called idle land. Although nearly 5 million hectares of arable land is currently not being planted (or is not being reported as planted), analysis suggests that less than half of this area is likely to be returned to crop production, and that this will occur only gradually.

According to the State Statistical Committee of Ukraine (SSC), the amount of agricultural land officially reported as arable (this can loosely be described as tillable land and does not include permanent hayfields or pastures) has decreased from 33.4 million hectares in 1990 to 30.8 million in 2006, a drop of 2.6 million or 8 percent. According to the State Statistical Committee of Ukraine (SSC), the amount of agricultural land officially reported as arable (this can loosely be described as tillable land and does not include permanent hayfields or pastures) has decreased from 33.4 million hectares in 1990 to 30.8 million in 2006, a drop of 2.6 million or 8 percent.

Total sown area (the area planted to grains, cultivated forage crops, technical crops including sunflowers and sugar beets, and vegetables and potatoes) fell as well over the same period, but at a steeper rate: from 32.0 to 25.9 million hectares, a drop of 6.1 million or nearly 20 percent. The decline can be attributed almost exclusively to a reduction in forage-crop area (chiefly silage corn, grasses, and alfalfa) coincident with a 74-percent slide in livestock inventories.

The SSC data indicate that the amount of unplanted arable land increased from 1.4 million hectares in 1990 to 4.9 million in 2006. This is the area typically referred to as idle land. In percentage terms (the ratio of idle to arable land in each oblast), idle land tends to be concentrated in the north and west. But in terms of actual area, much of the idle land is situated in southern, central, and eastern Ukraine – the country’s prime agricultural zone. Several factors will prevent the majority of this land from being returned to agricultural production in the near future, if at all:

Fallow: In any crop year, a portion of the arable land remains intentionally unplanted in order to replenish subsurface moisture reserves for subsequent crop years. This is classified as clean fallow, and during Soviet times roughly 1.0 to 1.5 million hectares of arable land would lie fallow every year. A clean-fallow field should not be considered idle land as long as it remains part of the regular crop rotation. (A typical crop rotation in southern Ukraine, for example, might include clean fallow once every seven years.) But the significant increase in reported fallow following the breakup of the Soviet, from 1.4 million hectares in 1990 to 3.2 million by 2000, suggests that a considerable portion of total fallow area was essentially pulled out of production, likely due in part to the dire financial conditions faced by many former State farms and the lack of resources required to plant and harvest the fields. Reported fallow area began to decline in 2000, however, as agricultural enterprises began to attract investors, and by 2006 stood at 1.9 million hectares.

Formerly drained land: About 3 million hectares of Ukraine’s agricultural land requires drainage in order to be productive. Following the breakup of the Soviet Union, land amelioration (drainage) was drastically curtailed. In 1990, the area of drained land on agricultural enterprises was 2.8 million hectares but by 2006 less than 1.2 million was being drained. Much of the undrained land has become unsuitable for cultivation and accounts for a portion of the idle land. Specialists indicate also that an indeterminate amount of agricultural land has been subjected to severe soil erosion and is unsuitable for planting although it remains officially classified as arable land.

Unreported sown area: Estimates of the amount of idle land are likely inflated by the inclusion of land that is planted but not reported. Roughly 2 million hectares of arable land was transferred to private citizens following the liquidation of the State and collective farms. Some of this land is being used for household vegetable production but is not being reported as sown area in official statistics.

According to an official at the State Statistical Committee, between 5 and 7 percent (over 2 million hectares) of Ukraine’s arable land is actually not being planted. For example, older shareholders may have difficulty finding renters for their land shares, or land shares may have been passed on to children who are not leasing the land. These shares include some potentially highly productive land in key agricultural regions. It is this component of the idle-land equation (i.e., the 2 million hectares) that can reasonably be considered available – but not necessarily immediately available – for agricultural production.

The consensus among Ukraine’s major independent commodity analysts is that only a relatively small increase in planted area will result from the recovery of idle land within the next few years. Two related factors will hinder reclamation efforts: high reclamation costs, and the reluctance of investors to make improvements on land that they do not own. Recovery costs are extremely variable, depending on the location of the land and how long it has been out of production. In some cases, recovery costs can be surprisingly low. The team visited an agricultural enterprise in southern Ukraine that had recently acquired 2,000 hectares from a former collective farm. The land was used previously for wheat production but had been idle for eight years. The director estimates that reclamation costs will amount to only $60 per hectare: $30 for Roundup to eliminate the weeds, and $30 for additional cultivation.

On the other hand, reclamation costs can be prohibitively high on fields in northern and western Ukraine that have been idle for over ten years and have become overgrown. The director of AAA, an agricultural consultant agency in Kiev, estimates that costs can run as high as $700 per hectare to reclaim fields on which trees have become established and must be removed. Even at today’s high commodity prices it would be difficult for investors to recover over $500 of reclamation in addition to the standard crop-production costs. Furthermore, recovered land requires two to three years under good management before it will deliver good yields. For idle land with a high estimated cost of recovery, like land requiring drainage or fields overgrown with trees, investors are unlikely to pay for improvements on leased land when the shareholder could easily decide to rent the land to a different investor when the current lease expires.

Land Sales

A current moratorium against agricultural land sales in Ukraine is slated to expire in January 2009. Although what will happen in February 2009 is anyone’s guess, the Ukrainian parliament is fairly evenly divided between supporters and opponents and the moratorium is likely to be extended beyond 2009. Observers offer differing views on what will happen when the moratorium is repealed. The possibility exists that some of Ukraine’s huge agricultural enterprises or other large companies could purchase large tracts of agricultural land when it becomes legally possible, and some experts suggest that investors are positioning themselves \for large-scale land purchases. Others maintain that this is unlikely to occur; what investors want is stability, not necessarily land ownership, and long-term leasing (i.e., leases with ten-year terms or greater) is essentially as good as owning.

Current USDA area and production estimates for grains and other agricultural commodities are available on IPAD’s Agricultural Production page, or at PSD Online.

|