Ukraine: Early Prospects for 2009/10 Winter Grains

Current conditions and early prospects for 2009/10 winter grains in Ukraine are reasonably good as planting nears completion. Sown area has surpassed the Ministry of Agriculture's target despite rain-related planting delays in mid-September, and planting is reportedly ahead of last year's pace. Weather and soil-moisture conditions are generally favorable despite recent dryness.

Sown area

According to data from the Ministry of Agriculture, 7.96 million hectares of winter grains had been sown by November 6, against the Ministry forecast of 7.43 mha. Although sown winter-grain area to date is up nearly 0.5 million hectares from last year, wheat area is reportedly below last year's level. According to analysts at UkrAgroConsult, a leading commodity-analysis group in Kyiv, the mid-September interruption in the sowing campaign encouraged farmers to plant barley rather than wheat when planting resumed, because winter barley is more tolerant of late sowing. Planting-progress data indicate that winter-barley area has exceeded 1.0 million hectares, over 50 percent above the official forecast.

Winter wheat typically accounts for 90 to 95 percent of Ukraine’s total wheat area and about 85 percent of winter-grain area, although wheat's relative share of winter grain area is likely to drop this year due to the increase in winter barley area. Winter wheat is grown throughout the country, but southern and eastern Ukraine comprise the main production region, accounting for nearly 70 percent of the country's total wheat output. Winter barley is grown primarily in the southern territories, and rye in the north and west. The sowing campaign for winter crops typically begins in late August (in the north and west) and concludes in late October (in the south).

Winter rape has emerged as a highly popular and profitable oilseed crop in recent years. Area skyrocketed from less than 0.1 million hectares for 2003/04 to 1.4 million for 2008/09. Sown area for 2009/10 reportedly reached 1.3 million hectares as of October 13, matching the Ministry of Agriculture forecast. Since planting was largely complete by that date, sown area is unlikely to match last year’s level.

Planting and Establishment Conditions

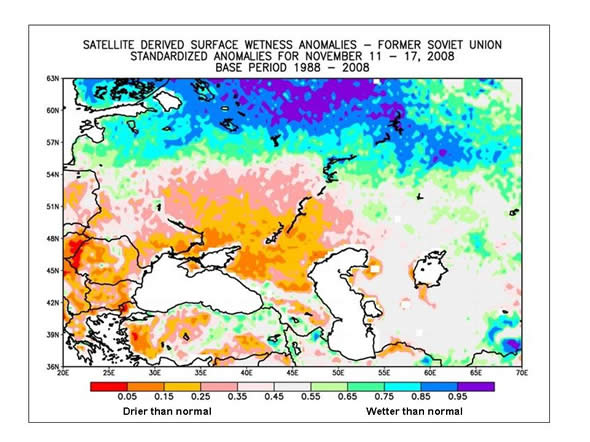

Cool, wet weather in mid-September interrupted sowing operations but replenished sub-surface soil moisture reserves in most regions of Ukraine. Although the dry and seasonably warm October weather enabled planting to resume at a rapid pace, the below-normal precipitation has reduced topsoil moisture throughout the country. Moisture-anomaly indices derived from microwave satellite imagery indicate that surface moisture has been persistently below normal for the past four weeks, especially in eastern Ukraine. Despite the decreasing surface moisture, however, local reports indicate that winter crops are in generally good condition. Furthermore, fall moisture conditions are a notoriously unreliable indicator of winter-grain yield. Favorable spring weather can, and frequently does, compensate for fall dryness.

Daily temperature data indicate that winter grains in northern and central Ukraine, and parts of eastern Ukraine, have ceased vegetative growth and begun the hardening process prior to entering dormancy. Vegetative growth continues in southern territories.

Winterkill

Ukraine's winter crops have benefited from relatively mild winter weather in recent years. Except for the 2003/04 crop, when widespread ice crusting destroyed over 60 percent of the country's winter grains, winter losses have been below 5 percent for the past 8 years according to data from the State Statistical Committee of Ukraine. In a normal season (i.e., assuming average temperatures and the presence of protective snow cover), wheat is fully dormant by mid-December and capable of surviving typical winter conditions.

Plunging Prices

Ministry forecasts of a 10-percent year-to-year decrease in 2009/10 winter-grain area were likely based in part on sliding wheat prices  prior to planting. Although domestic prices for feed wheat in Ukraine during August 2008 (at the launch of the sowing campaign for 2009/10 winter grains) were roughly similar to prices of one year earlier, the situations were quite different. In August 2007, prior to 2008/09 winter-grain planting, wheat prices had been climbing steadily for nearly two years on their way to reaching record levels in April 2008. Partly as a result of the rapidly rising prices, sown winter-grain area for 2008/09 increased by 17 percent from the previous year. By the time farmers were preparing for planting of 2009/10 winter wheat, prices had been declining for several months. Since peaking in April the price of feed wheat (offer EXW) has fallen by nearly 66 percent -- the result of a bumper 2008/09 crop combined with substantial carryover stocks from the 2007/08 harvest caused by government-imposed limits on exports. prior to planting. Although domestic prices for feed wheat in Ukraine during August 2008 (at the launch of the sowing campaign for 2009/10 winter grains) were roughly similar to prices of one year earlier, the situations were quite different. In August 2007, prior to 2008/09 winter-grain planting, wheat prices had been climbing steadily for nearly two years on their way to reaching record levels in April 2008. Partly as a result of the rapidly rising prices, sown winter-grain area for 2008/09 increased by 17 percent from the previous year. By the time farmers were preparing for planting of 2009/10 winter wheat, prices had been declining for several months. Since peaking in April the price of feed wheat (offer EXW) has fallen by nearly 66 percent -- the result of a bumper 2008/09 crop combined with substantial carryover stocks from the 2007/08 harvest caused by government-imposed limits on exports.

No Yield Trend

Despite a gradual but steady improvement in agricultural technology over the past ten years, including increases in the use of fertilizer and certified planting seed, Ukraine wheat yields have not exhibited a consistent upward trend. Quite the contrary: prior to the astonishing rebound in 2008 (which was due chiefly to remarkably favorable weather), Ukraine wheat yields had decreased for three consecutive years. Yield can fluctuate significantly from year to year and weather remains the chief yield determinant. Meanwhile, yields for corn and sunflowerseed have increased steadily and significantly, due in large part to an explosive growth in the use of hybrid seed which has increased the crops' resistance to drought and pests. Despite a gradual but steady improvement in agricultural technology over the past ten years, including increases in the use of fertilizer and certified planting seed, Ukraine wheat yields have not exhibited a consistent upward trend. Quite the contrary: prior to the astonishing rebound in 2008 (which was due chiefly to remarkably favorable weather), Ukraine wheat yields had decreased for three consecutive years. Yield can fluctuate significantly from year to year and weather remains the chief yield determinant. Meanwhile, yields for corn and sunflowerseed have increased steadily and significantly, due in large part to an explosive growth in the use of hybrid seed which has increased the crops' resistance to drought and pests.

Current USDA area and production estimates for grains and other agricultural commodities are available on IPAD’s Agricultural Production page, or at PSD Online. The contribution of Olena Pereyatenets, agricultural specialist at the U.S. Embassy in Kyiv, is gratefully acknowledged.

|