INDONESIA: Palm Oil Production Growth To Continue

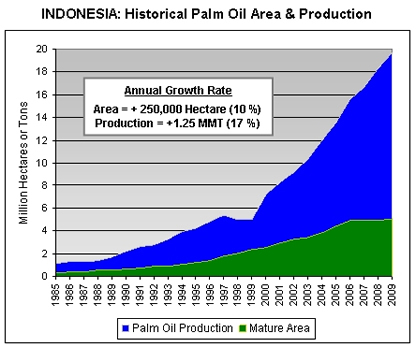

Extremely high palm oil production growth rates have been sustained over the past ten years in Indonesia. These historic growth rates are a result of strong global vegetable oil demand and significant political and economic reforms established by the government following the Asian Financial Crisis in the late 1990’s.  Chief among the reforms were the designation of large land tracts to the development of future palm plantations, decentralizing control over land-use licensing to provincial governments, and subsidizing credit and establishment costs for smallholder's interested in palm. In addition the government fostered an investment environment which favored foreign commercial enterprises, while also encouraging the export market by establishing a pro-rated export tax system for crude palm oil (CPO) which fluctuates with the international market. As a result, during the 2000-2009 period mature palm area has grown at an average annual rate of 10.0 percent or 250,000 hectares, while palm oil production has increased by 17.4 percent or 1.25 million metric tons per annum. At a time when global palm oil demand was growing 2.2 million tons per year, Indonesia was able to reliably supply roughly 57 percent of the annual increase. With vast land resources and a suitable climate, what is the outlook for continued growth in palm oil production? Analysts from the USDA Foreign Agricultural Service (FAS) in Washington and the U.S. Embassy in Jakarta investigated this issue during recent travel in Sumatra and Java. Chief among the reforms were the designation of large land tracts to the development of future palm plantations, decentralizing control over land-use licensing to provincial governments, and subsidizing credit and establishment costs for smallholder's interested in palm. In addition the government fostered an investment environment which favored foreign commercial enterprises, while also encouraging the export market by establishing a pro-rated export tax system for crude palm oil (CPO) which fluctuates with the international market. As a result, during the 2000-2009 period mature palm area has grown at an average annual rate of 10.0 percent or 250,000 hectares, while palm oil production has increased by 17.4 percent or 1.25 million metric tons per annum. At a time when global palm oil demand was growing 2.2 million tons per year, Indonesia was able to reliably supply roughly 57 percent of the annual increase. With vast land resources and a suitable climate, what is the outlook for continued growth in palm oil production? Analysts from the USDA Foreign Agricultural Service (FAS) in Washington and the U.S. Embassy in Jakarta investigated this issue during recent travel in Sumatra and Java.

Current Situation

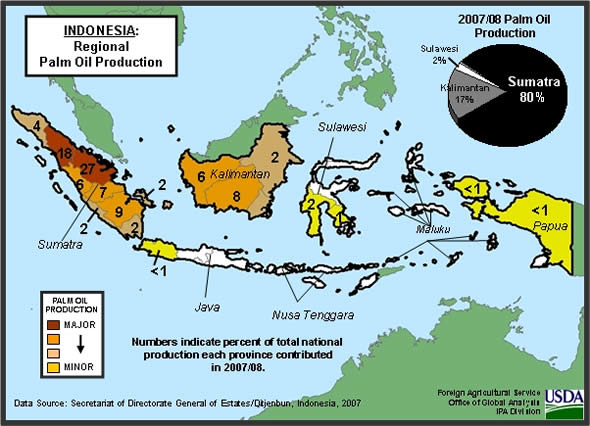

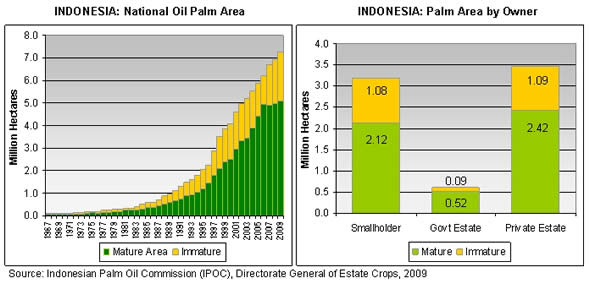

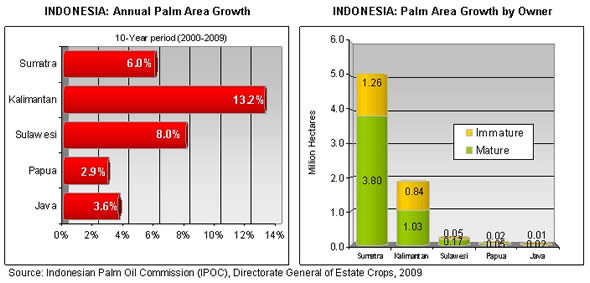

Commercial palm oil production in Indonesia originated with Dutch colonial plantations on the island of Sumatra, where the rich volcanic soils and tropical climate were best suited for the crop. Today Sumatra is still home to the majority of the national palm crop, with 75 percent of total mature palm area and 80 percent of total palm oil production. In recent years Indonesia has successfully encouraged expansion of the crop in more remote locations on the islands of Kalimantan (Borneo), Sulawesi and Papua. Kalimantan and Sulawesi in particular have experienced strong development, averaging 13 percent and 8 percent annual growth rates in palm area respectively over the past ten years. Meanwhile expansion is still occurring on Sumatra, with an additional 600,000 hectares being planted between 2000 and 2009, or a 6 percent annual rate of growth over the last decade. In total, mature palm area in Indonesia has doubled from the levels recorded in 2000, and currently is estimated by the Indonesian Palm Oil Commission (IPOC) at 5.06 million hectares. Recently planted immature palm area is also estimated by IPOC at approximately 2.2 million hectares, indicating a huge pool of new crop area is nearing productive age.

Oil palm is an extremely labor intensive and costly plantation crop to establish and manage. Therefore plentiful credit at attractive interest rates is required to underwrite rapid large-scale growth in the industry. On the private sector side, these conditions have existed since 2000, enabling commercial palm companies to obtain adequate financing to establish roughly 1.1 million hectares of new plantations. At the same time, the Government of Indonesia has provided various subsidy programs over the past decade to encourage the expansion of palm plantations managed by non-commercial Indonesian farmers, called smallholder's. The government has sought to subsidize plantation establishment costs through the provision of loans at preferential below market interest rates, and through programs supplying improved seed and fertilizers. As a result of these successful interventions, smallholder palm area grew 2.0 million hectares since 2000, and now accounts for 44 percent of total palm area in the country (2nd only in total acreage to private commercial estates).

In addition to establishing vast new areas of palm plantations, many new palm oil processing plants had to be financed and built in the regions experiencing rapid growth. Fresh fruit bunches must be processed within 48 hours of harvest, thus requiring that oil processing plants be located in the midst of major concentrations of plantations. Construction and operation of each plant represents a significant fixed cost for the developer, and typically ends up servicing both commercial and smallholder palm producers that surround it. As of 2007 the IPOC indicates that 349 oil processing plants or 83 percent of the national total were located in Sumatra, 57 plants or 14 percent in Kalimantan, 8 plants or 2 percent in Sulawesi, and 5 plants or 1 percent in Papua. Collectively the 421 plants in Indonesia have a current capacity to process 18,343 tons of fresh fruit bunches per hour.

Following the massive investment in plantations and processing plants throughout Indonesia over the past decade, palm oil production growth has been extremely rapid. Total production in 2008/09 is estimated by USDA at 19.7 million tons, up 12.5 million or 174 percent from levels 10 years ago (1999/00 palm oil production estimated at 7.2 MMT). During this period Indonesia became the world’s leading producer of palm oil and currently is forecast to contribute nearly half (46 percent) of total world production. Palm oil is the country’s most important agricultural export crop, with 2008/09 exports forecast by USDA at 14.6 million tons. Palm oil exports have increased 10.7 million tons or 274 percent over the past decade or roughly 1.1 million tons or 27.4 percent a year. Domestic consumption of palm oil has also increased over the past ten years and is currently forecast at nearly 5.0 million tons, up 1.8 million or 58 percent from 1999/00 levels.

Recent Palm Expansion

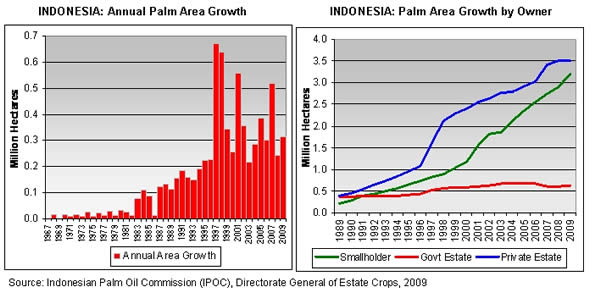

The rate at which new palm area is being established in Indonesia has reached new historical highs over the last ten-year period, as significant reforms in government economic and political policy targeting the oil palm industry revitalized investment and spurred expansion. These changes have been criticized by many outside Indonesia for fostering the replacement of natural rain forest with palm plantations, and diffusing responsibility to provincial governments where economic pressures to exploit the environment are more immediate and international pressures to halt palm expansion are easier to resist. The average annual rate of growth in oil palm area accelerated to 340,000 hectares per year from 2000-2009, compared to 14,000 hectares in the 1970’s, 71,000 hectares in the 1980’s, and 293,000 hectares in the 1990’s.

Chief among the reforms which set the stage for this remarkable growth were the allocation and issuance of approximately 10.0 million hectares of new land-use licenses between 2000-2009 to domestic and foreign individuals or companies interested in palm plantation development. The terms of official land-use permits were also liberalized, increasing the guaranteed length of time that companies would have control over the products and profits generated from newly established palm plantations from an earlier limit of 25 years to a current level of 95 years. This change resulted in much greater long-term security to foreign investors, and contributed to massive new investment in Indonesia. It is estimated by the IPOC that approximately 3.4 million hectares of the land licensed to be developed was planted to oil palm trees in the past decade.

Substantial up front costs, in the realm of US$8000 per hectare are often required to establish new commercial plantations in Indonesia. Private companies are allowed to own upwards of 100,000 hectares in total, and financial conglomerates are not prevented from establishing any number of new independent palm companies in order to secure more land. It is estimated by the IPOC that private commercial entities have accumulated nearly 3.3 million hectares of land which is currently inactive but available to be developed when financial and economic conditions warrant. These “land banks” are a common feature of large-scale private palm companies in Indonesia. Government plantation companies are also reported to have development permits on approximately 3.3 million hectares of land, which brings total undeveloped but licensed land to 6.6 million hectares in 2008.

Palm trees typically begin flowering and producing fruit after 3-4 years, and yield well enough after 6-8 years for the owner to return a profit. Oil palm plantations generally remain profitable for 25 years, after which they need to be replanted. Peak palm oil yields occur anywhere between 10 to 18 years of age, and gradually decline thereafter. As a plantation ages it also tends to experience declining tree populations as a result of pests and diseases. Newly established plantations might have 130-145 trees per hectare, whereas an old plantation might be reduced to approximately 100 trees per hectare. The huge start-up costs and long lead time between plantation establishment and profitability are huge impediments to independent small farmers in Indonesia. And that is precisely why the government has had to provide substantial long-term capital and subsidies to smallholder's to ensure they have the ability to participate in the industry. In a typical new plantation (either government or private estate) the government or private owner will underwrite the entire establishment cost of the farm, with land prepared and planted. Smallholder's, who occupy a portion of the plantation, essentially take out a subsidized loan and are obliged to pay the owner back for a portion of the establishment costs over a 15 year period. The IPOC indicates that roughly 98 percent of all smallholder palm farmers have successfully paid off their loans in the past 10 years.

The expansion of oil palm plantations during the last decade, in regard to gross land area developed has been particularly pronounced on the islands of Kalimantan, Sulawesi, and Sumatra. Official government statistics indicate that 79 percent of total new area devoted to palm production occurred on these three islands, with approximately 1.3 million hectares being established in Kalimantan, 0.8 million on Sulawesi, and 0.6 million on Sumatra. As the graph above illustrates, the largest share of immature palm area currently resides on Sumatra and Kalimantan. In addition, official plantation statistics indicate the rate of growth was greatest amongst the smallholder group, with annual increases in total palm area established of approximately 17.4 percent. This compares to the private commercial estates, which recorded a growth rate of 4.6 percent per year. The IPOC indicates that in 2008 there were roughly 1.5 million smallholder palm producers in Indonesia, with an average farm size of 2.0 hectares. There are also 10 government companies making up the government estate owner category, which operate 176 plantations with an average plantation size being 3,900 hectares. Meanwhile there are also reportedly 814 private palm companies which operate 1,006 plantations with an average size of 3,500 hectares.

Future Growth Potential

The USDA estimates that global edible oil demand has increased approximately 5.0 million tons a year over the last decade, while palm oil demand has grown an average of 2.2 million tons a year. Should these rates of growth in world edible oil demand continue through the next decade, perhaps the best chance for limiting edible oil prices for consumers in much of the developing world is for continued strong expansion of the Indonesian palm sector. Though a radically larger area devoted to oil-palm plantations in Indonesia is opposed by the global environmental and climate community, it is a fundamental reality of current and future global food supply interdependencies. There is, however, a growing movement in Indonesia toward producing crude palm oil in an environmentally sustainable manner, and these practices are expected to become more widespread in the future. The elemental issue is that palm oil is the leading global edible oil, and Indonesia is the key country capable of large-scale expansion over the next few decades.

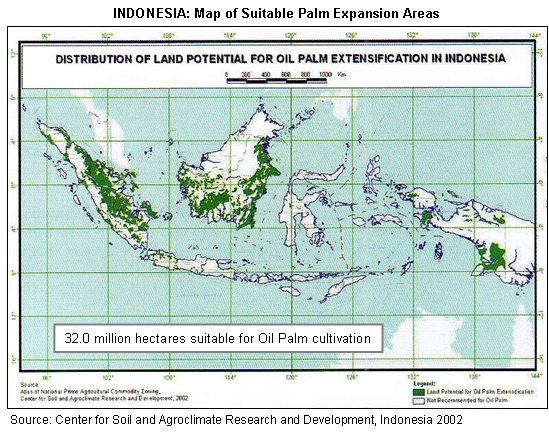

In 2004, the Indonesian government, through the auspices of the office of the Directorate General of Plantation Production and Development (DGPPD), determined that there were approximately 32.0 million hectares of suitable land for oil palm plantation development in the country. As of early 2009, the IPOC estimated that about 7.32 million hectares of palm plantations (mature and immature) had already been established, leaving an additional 24.5 million available for future expansion. As far as the geographical distribution of potentially suitable land, garnered from the DGPPD government analysis, there is about 10.3 million hectares in Kalimantan, 7.2 million in Sumatra, 6.3 million in Papua, 0.37 million in Sulawesi, and 0.29 million in Java. The fact that the land is designated as suitable for palm plantations does not necessarily mean it is likely to be developed. On most of the islands outside Sumatra, oil palm processing and transportation infrastructure is extremely limited, though land costs are very low. In addition to forest destruction, most new plantations created displace local subsistence agricultural communities, while land rights, land-use, and compensation negotiations are often expensive and arduous to complete. Given these conditions, whether or not Indonesia can maintain current historically high annual palm area expansion rates (averaging 340,000 hectares per year) is unknown. But it is clear that vast new areas of exploitable land exist and are capable of being developed for palm oil production.

In the short-term the IPOC reported in 2007 that the Indonesian government planned to establish 1.35 million hectares of new plantations by 2010, and it appears at least 6.6 million hectares of land with official palm development licenses is available in the immediate future. The IPOC goes further by indicating the government has targeted total palm oil production to reach 28.0 million tons by 2015, which is an 8.3 million ton increase over 2008/09 levels and would require roughly 7.4 million hectares of mature area at current national average yields. Even when considering only the current immature plantation area in the country of roughly 2.2 million hectares, it is apparent that Indonesian palm oil production will continue to increase at approximately trend levels over the next 6-8 years.

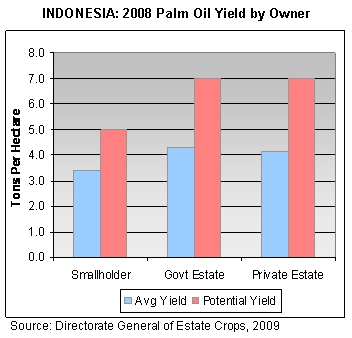

There is also a huge potential to increase palm oil production over the next few decades by focusing attention and resources on crop yield improvement in addition to, or in lieu of area expansion. It is well known that smallholder's who own and operate nearly half of total palm area in Indonesia apply little to no fertilizer on their land and that the genetic stock growing on their properties is generally inferior to that propagated by government and private estates. Seed researchers and hybrid seed production companies have noted that if smallholder's simply planted new high-yielding varieties they could achieve average palm oil production yields of 5 tons per hectare without fertilizer, a potential increase of 47 percent over current levels. There is also a huge potential to increase palm oil production over the next few decades by focusing attention and resources on crop yield improvement in addition to, or in lieu of area expansion. It is well known that smallholder's who own and operate nearly half of total palm area in Indonesia apply little to no fertilizer on their land and that the genetic stock growing on their properties is generally inferior to that propagated by government and private estates. Seed researchers and hybrid seed production companies have noted that if smallholder's simply planted new high-yielding varieties they could achieve average palm oil production yields of 5 tons per hectare without fertilizer, a potential increase of 47 percent over current levels.

It is also apparent when scrutinizing local and provincial production data that there is only a marginal gap between smallholder yields and those achieved on government and private estates. Furthermore, the gap between yields on truly well-managed and high-yielding private estates and the national average for their group is much larger than it should be. Private producers have recorded 6.5 to 8.0 tons per hectare average yields on individual plantations, yet the average for the group is little better than 4.1 tons per hectare. The gap between yields on smallholder subsistence properties and private estates is inexplicably low, given the tremendous advantages that private estates have in capital, land management ability, fertilizers, and better high-yielding varieties. It appears that there is a serious under-investment in fertility management even in a producer group which has the financial ability to engineer higher yields. It is also possible that producers on private estates haven’t been motivated to manage their trees more intensively, with higher investment in optimal fertilizer application, because they already achieve sufficient profit margins at nominally lower yields. It is not uncommon for producers to achieve a 20 percent or greater gross margin with average yields at current national levels and palm oil prices around US$500 FOB Malaysia.

Impediments to Potential Growth

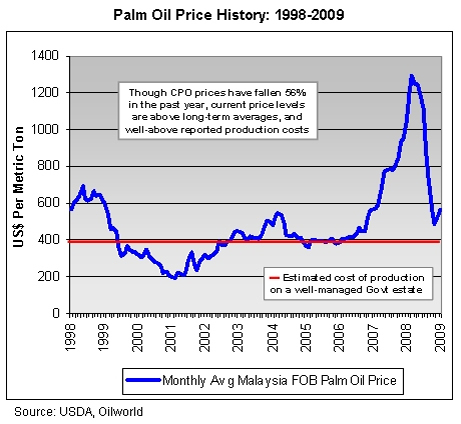

Given the evidence available today, it appears that the expansion of palm plantations in Indonesia over the longer-term will continue along its current growth path for quite a few years. The global credit crisis and the sharp decline in international palm oil prices during 2008 and 2009 may act to suppress expansion to a modest degree over the next few years, but as long as world edible oil demand continues to grow at current rates, there will be an impetus to increase production inside Indonesia. It appears unlikely that political or economic forces will forestall the current trend, though possible impediments have been suggested, such as a moratorium on forest clearing and timber extraction, a revocation of outstanding palm plantation development licenses, a moratorium on future licenses, or lastly global environmental legislation which explicitly prohibits the import of edible palm oil or its products (oleo-chemicals) from land converted from tropical forest. There is a current international movement in the European Union and in the United States to prohibit the import of palm-based biodiesel and prohibit the use of palm oil as a feedstock for biodiesel production, however, despite the evolving politics of international biodiesel regulations it is unlikely that anything other than a significant drop in global palm oil prices and/or demand will derail the current growth trend in Indonesia.

In the short-term, palm oil prices have dropped approximately 56 percent over the past year, implying a huge decline in profit margins for producers and exporters of palm oil and its derivatives. The record increase in world palm oil prices during the 2007-08 period may have produced a short-lived spurt in plantation establishment, as it radically increased the annual profits of producers. However, given the recent collapse of global credit markets, it is expected that most private and smallholder operators will reduce their expansion plans over the next couple of years. This sentiment was expressed by numerous officials in the Indonesian government and in private sector palm production companies. In addition, it was reported that as happened during the Asian financial crisis of 1997-99, palm seed sales throughout Indonesia have declined 30-50 percent in 2009 as producers alter their planting targets and cancel a major portion of their seed orders. This indicates more than anything that new plantation establishment will slow in 2009 and possibly 2010. One mitigating factor which may forestall any serious short-term decline in area and production growth is that though international palm oil prices have fallen precipitously in the past year, they are currently above long-term averages and are well above actual production costs for most producers in the country. Interviews with major producers in Sumatra revealed that their average cost of production per hectare in 2009 would be US$400 per hectare. Despite the huge decline in prices, they are still able to achieve a 20 percent or higher gross margin when prices range in the low US$500 range. And given smallholder's have much lower costs; they are also assured a healthy return under current circumstances. It might even be said that international CPO prices at current levels are modestly stimulative insofar as the established palm sector in Indonesia is concerned.

Current USDA area and production estimates for grains and other agricultural commodities are available on IPAD's Agricultural Production page or at PSD Online.

|