SYRIA: 2012 Wheat Production Outlook is Favorable Despite Ongoing Conflict

The uprising against the government in Syria is entering its 16th month, with violence against civilian populations escalating dramatically in 2012. The bulk of military and paramilitary activity this year has been focused in the major cities and surrounding villages or towns in a large arc of western Syria’s agricultural belt, including the cities of Homs, Hama, Aleppo, Idlib, and Dar’a. Atrocities with mass casualties have become more common in recent weeks in Homs and Hama and the surrounding rural countryside, with localized food security deteriorating rapidly. Though the general food supply in the country is reported to be adequate, availability of food (especially bread), fuel, and medicine in cities and towns affected by recent military activity is extremely limited owing to the disruption of distribution networks and infrastructure. Tens of thousands of people have reportedly fled to nearby regions, including Turkey, to escape the conflict. The unknown element in the situation is how the rural community which is dispersed across the extent of the country’s grain growing regions is coping, and whether the conflict will in any way affect their ability to successfully harvest and market the 2012 winter grain crop.

Background

Syria’s economy is under extreme pressure owing to coordinated international sanctions (U.S., European, Japan, and Arab-Turkish) which include an embargo on oil exports, seizure of foreign-held Syrian assets, and severe restrictions on trade, financial transactions, and investment. The net result of international actions has been to trigger a major depreciation in the Syrian currency (50%), dramatically increase domestic inflation, significantly deplete government financial reserves, and seriously restrict trade. Though current sanctions do not officially target food or agricultural commodities, restrictions imposed on Syrian banks and trading firms have somewhat impeded the country’s ability to finance needed imports. According to the Syrian Central Bureau of Statistics (CBS) the nation’s inflation rate stood at 21.0 percent in February 2012, which was sharply higher than last year owing to escalating food and fuel prices. The CBS also reported that monthly food price inflation reached 25.8 percent in February, compared to an average of 8 percent in 2011. Wheat is the most important staple food commodity in the country and is consumed primarily as bread. It is also the country’s only strategic food security commodity, and is treated accordingly. The government controls the pricing of wheat, flour, and bread throughout the entire public and private sector marketing chain. Wheat production is heavily subsidized through the government’s payment of premium (above international market) prices to growers, while bread consumption is also heavily subsidized through government imposed price controls (averaging 20% below the cost of production). The majority of national flour milling capacity and bakeries producing standard bread products are also in the hands of government-run enterprises, so there is strict official control over the supply of this staple food product. Local sources inside Syria currently indicate that with the exception of areas experiencing active conflict, the bread supply is near normal, with subsidized bread selling for roughly 8 Syrian Pounds per kg (11 U.S. cents).

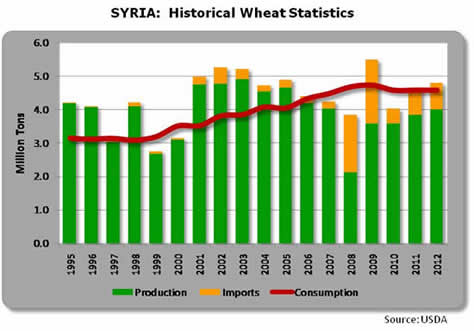

Syria has been essentially self-sufficient in wheat production for the past 20 years, with the infrequent exception of seasons when severe drought prevails (ex. 2008). Wheat self-sufficiency has been a major policy objective of the government, which over the years encouraged the expansion of sown area and the development of increased irrigation infrastructure to ensure production growth kept pace with gradually increasing domestic consumption. The government also instituted a program to domestically procure or import enough wheat on an annual basis to maintain strategic national wheat stocks of approximately 3.0-4.0 million tons – roughly one year’s consumption requirements. USDA currently estimates that Syria had approximately 2.9 million tons of wheat in reserve prior to the 2012 harvest. As the country’s main winter cereal harvest approaches it appears Syria may benefit this year from relatively favorable wheat production prospects, if conflict and/or fuel shortages don’t interfere or inhibit farmer’s ability to bring in the harvest. The agency responsible for government grain procurement is the General Establishment for Cereal Processing and Trade (HOBOOB). Though the wheat market in Syria is heavily controlled by the government, farmers technically have the right to withhold grain for their own consumption and/or to sell to private buyers/millers inside the governorate (U.S. county equivalent) where they reside. In practice, farmers usually deliver 70-75 percent of the national harvest to the government, keeping 20-25 percent for themselves for local consumption. According to recent reports, HOBOOB will be offering Syrian farmers US$326.0 a ton for hard wheat and US$319.0 for soft wheat during this year’s harvest (International price for wheat is US$264.0 for U.S. No. 1 hard red winter wheat, FOB Gulf of Mexico in May 2012). Most wheat storage capacity in the country remains in the hands of the government, and consists of concrete and metal silos. Total concrete silo storage capacity is estimated at roughly 2.0 million tons, whereas metal silo capacity is approximately 1.4 million tons. These bulk storage silos are widely distributed throughout the grain producing regions and major cities. Wheat can also be stored in bags in warehouse facilities if needed, as this was a very common practice in the past to store sizable quantities (millions of tons) of grain.

Wheat Cultivation

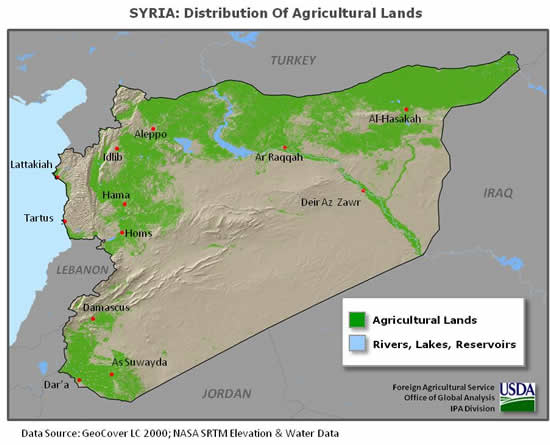

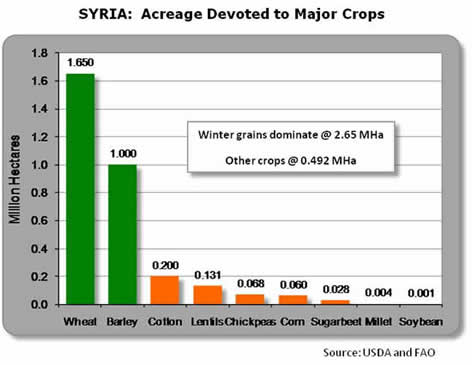

Approximately two-thirds of Syria is too arid for agriculture, being either desert or covered by sparse native grasslands (see map of agricultural lands above). Food crop cultivation is limited to an arc of land stretching along the western Mediterranean coast and eastward following the northern border with Turkey, where prevailing weather patterns provide between 150-700 millimeters (6-28 inches) of autumn and winter rainfall. Wheat is the most important cereal grain grown, encompassing nearly 60 percent of total cultivated agricultural land.

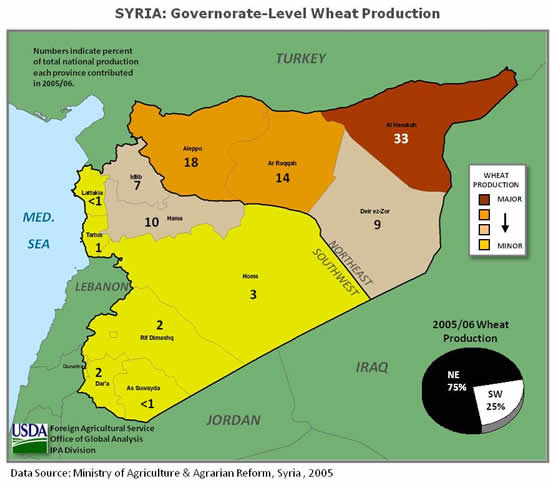

Wheat is grown throughout the agricultural belt in a wide variety of microclimatic environments, under both irrigated and rainfed conditions. The crop is typically planted in the autumn (October-December) and harvested in early summer (June-July). Approximately 53 percent of the national wheat crop is totally reliant on rainfall, while approximately 47 percent of total area has access to irrigation. Rainfed wheat acreage is the majority of total sown area, and averages around 1.0 million hectares per year. Irrigated wheat is cultivated in virtually every province; however total acreage is insufficient to ensure national wheat self-sufficiency. Wheat is the single largest consumer of irrigation water in the country, accounting for roughly 60 percent of all land devoted to annual crops. Irrigated croplands normally contribute about 72 percent of total annual wheat production, while rainfed lands account for the remaining 28 percent. These totals can change dramatically during a severe drought, when irrigated lands would produce between 80-90 percent of total production. The country’s non-irrigated rainfed cropping lands are most predominant in the three northern provinces of Al-Hasakah, Ar-Raqqah, and Aleppo – which collectively account for nearly 80 percent of total rainfed wheat acreage.

Syrian farmers cultivate both hard (durum) and soft wheat varieties, with hard varieties being heavily concentrated on rainfed lands. Hard wheat production typically makes up approximately 60 percent of total annual output, with soft varieties accounting for the remaining 40 percent. The annual supply of domestically produced hard wheat in Syria, however, is extremely variable owing to the crops low average yields and vulnerability to adverse weather (low or improperly timed rainfall). Rainfed wheat yields in Syria average about 1.3 tons per hectare, but can be as low as 0.5 T/Ha in poor rainfall situations. Irrigated crop yields, by comparison, are about 63 percent higher, averaging near 4.2 tons per hectare.

2012 Wheat Crop Outlook

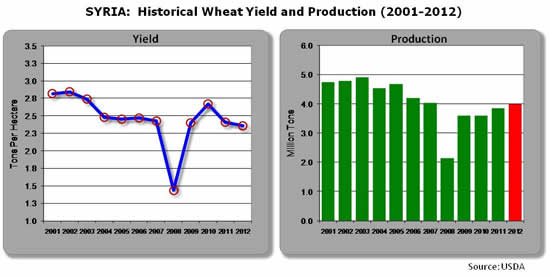

At the conclusion of USDA’s winter-long crop monitoring effort over Syria, it is apparent that the country has experienced a generally favorable wheat growing season this year, though regional moisture availability and growing conditions have been quite varied. Overall wheat production is estimated a little higher than last year, and about 14 percent above the 5-year average. USDA’s estimate released June 12, 2012 for marketing year 2012/13 wheat production is 4.0 million tons, up 0.15 million or 4 percent from last year. Harvested wheat area is forecast at 1.7 million hectares, up 0.1 million or 6 percent. Wheat crop yields in 2012 are forecast at 2.35 tons per hectare, which is slightly above the 5-year average and 2 percent lower than last year. In general terms, increased yields in heavily irrigated regions this year are expected to overcompensate for slightly lower yields in rainfed growing areas which were affected by below-normal rainfall.

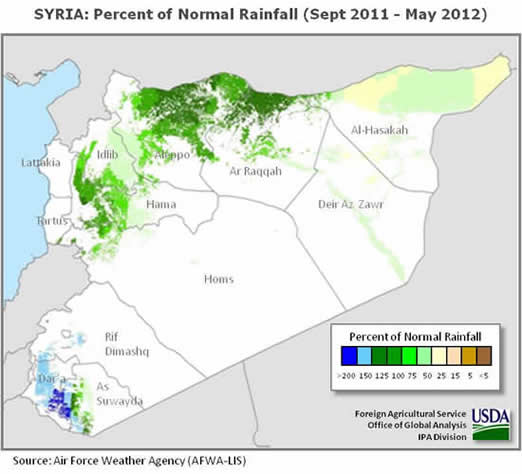

Seasonal cumulative rainfall in the major wheat growing regions of western and north-central Syria was especially favorable this year, being near-to-above normal. However, much of the major producing northeastern governorate of Al-Hasakah received 50 percent of normal rainfall or less – causing stressful growing conditions in its major rainfed cropping areas. Early season rainfall in the autumn of 2011 was very beneficial in virtually every major growing area, allowing farmers to get crops planted in a timely fashion. Crop emergence and establishment was also favorable in most areas before the cooler winter temperatures arrived. For the most part, rainfall was well-distributed throughout Syria during the 2012 wheat growing season, ensuring that even in the drier areas regular light showers kept crops progressing through each growth stage.

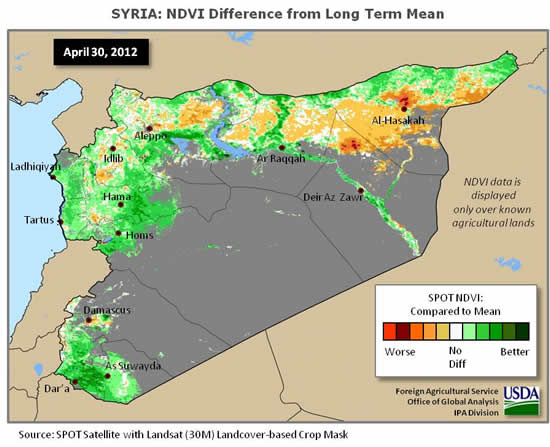

As a result of differing levels of rainfall in the winter grain cultivation regions this year, wheat crop development and yield potential is very mixed (see the Normalized Difference Vegetation Index -- NDVI map below). The NDVI map was created at a point in time (late April) when most wheat crops would normally be at peak growth stage (flowering), and therefore provide good indications of relative crop yield potential. What is apparent is that major irrigated crop areas in virtually every governorate are showing above-normal crop yield potential, whereas significant areas of rainfed crop lands in the north and northwest are showing below-normal potential. Most areas showing below-normal yield prospects are not generally in the severely low NDVI categories and therefore are expected to only have slightly diminished yield prospects from what they would normally achieve. Some areas in Al-Hasakah, however, have been more seriously affected by low rainfall, and will have significantly diminished production prospects. Al-Hasakeh is the country’s largest wheat producer, with over 800,000 hectares sown on average, of which 45 percent is irrigated. Though overall national crop conditions are highly variable, nationwide production potential is expected to be above average, because the overall gain in irrigated crop yields is expected to largely offset the decline in rainfed yields.

The 2012 wheat harvest in Syria will be underway soon if it has not already started, coming to completion sometime in late July. Crops in all locations are now in final grain-fill and/or maturation growth stages. The national wheat harvest is usually managed in a very organized and rapid fashion, though it is uncertain whether escalating conflict, ongoing military actions, or displaced rural farm households will cause significant interference this year. Rural communities are reportedly suffering from widespread fuel shortages, as the government stockpiles supplies for its military vehicles. Fuel (diesel) prices have also reportedly risen by at least 33 percent in recent weeks, owing to the nation’s continuing currency depreciation and government control over available supplies. Most harvest machinery is at least 10-20 years old, having been imported second-hand from Europe, and not terribly fuel-efficient. So even if farmers are able to acquire sufficient fuel to harvest the crop, it will cost considerably more to do so this season. In the end, the government has an inherent self-interest in ensuring the 2012 wheat harvest is reaped and procured, as it is currently the sole provider of needed supplies of subsidized wheat flour and bread. Wheat is a strategic commodity in Syria, so any disruption in the harvest this year will have serious ramifications for national food security.

Current USDA area and production estimates for grains and other agricultural commodities are available on IPAD's Agricultural Production page or at PSD Online.

|