Russia: Heat and Dryness Dim Wheat Prospects in the Southern District

Excessive heat and dryness during April and May has reduced yield prospects for winter wheat in Russia's Southern District, but improving crop conditions in the Central Distict and generally good conditions in the Volga District are likely to compensate in part for the drought damage in the south. The USDA estimates Russia wheat production for 2012/13 at 53.0 million tons, down 3.0 million from last month and down 3.2 million from last year.

Preliminary data from the Ministry of Agriculture and estimates from private commodity analysts indicate that winter grains for 2012/13 were sown on 16.1 million hectares, about the same as last season’s level. Detailed data citing the planted area of individual winter crops have not yet been published by Rosstat (the State Statistical Agency), but wheat typically comprises 80 to 85 percent of winter grain area, rye 10 to 15 percent, and barley 3 to 4 percent. Autumn weather was generally favorable for winter crops, except in the territories of Krasnodar and Stavropol in southern Russia where persistent dryness during October and November hampered emergence and establishment. (View map of European Russia including territory names.) Winter rape and barley in Krasnodar and Stavropol were subject also to frost damage in February, when temperatures plunged to as low as minus 30 degrees Celsius and snow cover in many areas was insufficient to protect the plants from the severe cold. (Since winter wheat is more resistant to low temperatures, frost damage to wheat was limited.) Total winter-crop losses are unofficially estimated at 9 to 10 percent, similar to last year’s level. Final Rosstat data on winterkill will be released in late summer.

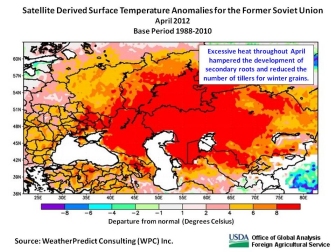

When winter grains broke dormancy and resumed vegetative growth in the spring, satellite-derived vegetative indices (NDVI) indicated that crop vigor was poor in Krasnodar and Stavropol but generally good in Rostov and Volgograd oblasts. These four territories in southern Russia together account for about 50 percent of the country’s winter wheat production. The favorable prospects in Rostov and Volgograd were expected to compensate in part for the poor conditions farther south. (Note that Volgograd oblast, despite the name, is located not in the Volga District but in the Southern District.) A sharp increase in April temperatures, however, combined with at least four consecutive weeks of mostly dry weather, had a significant negative impact on winter grains throughout southern Russia. The sudden April heat and prevailing dryness essentially brought an end to the tillering stage and seriously hampered secondary rooting for winter wheat in Rostov and Volgograd. (Tillering is the development stage during which the wheat plants produce additional stems that will in turn develop heads.) Above-average heat and dryness continued during the first three weeks of May and crop conditions deteriorated.

Analysts from the USDA Foreign Agricultural Service traveled to Russia’s Southern District in mid-May to examine production prospects for 2012/13 grain and oilseed crops. The team conducted field inspections and interviewed grain producers and local agricultural specialists. The team observed that crop conditions varied significantly from field to field, depending on crop rotation, technology, and the remarkably localized precipitation, but overall winter-wheat conditions in the Southern District were poor due to excessive heat and dryness that prevailed during most of April and May. Wheat plants in most fields had only one or two tillers rather than the four or five tillers typical of a good year. Many fields appeared to be in fairly good condition when viewed from the perimeter, but closer inspection revealed poor development and extremely low moisture. Topsoil moisture was low throughout southern Russia during the time of FAS field travel, and wide cracks in the soil were not uncommon. Late-May precipitation enabled overall vegetative conditions to improve in Krasnodar and to a lesser degree in Rostov, but the actual benefit to winter-wheat yield at this late stage in crop development was likely minimal. Crop development was accelerated this year due to the hot, dry weather, and in many areas the severe weather had already done irreparable damage to the wheat crop. The NDVI indicate that winter crops failed to recover in Stavropol and Volgograd. Analysts from the USDA Foreign Agricultural Service traveled to Russia’s Southern District in mid-May to examine production prospects for 2012/13 grain and oilseed crops. The team conducted field inspections and interviewed grain producers and local agricultural specialists. The team observed that crop conditions varied significantly from field to field, depending on crop rotation, technology, and the remarkably localized precipitation, but overall winter-wheat conditions in the Southern District were poor due to excessive heat and dryness that prevailed during most of April and May. Wheat plants in most fields had only one or two tillers rather than the four or five tillers typical of a good year. Many fields appeared to be in fairly good condition when viewed from the perimeter, but closer inspection revealed poor development and extremely low moisture. Topsoil moisture was low throughout southern Russia during the time of FAS field travel, and wide cracks in the soil were not uncommon. Late-May precipitation enabled overall vegetative conditions to improve in Krasnodar and to a lesser degree in Rostov, but the actual benefit to winter-wheat yield at this late stage in crop development was likely minimal. Crop development was accelerated this year due to the hot, dry weather, and in many areas the severe weather had already done irreparable damage to the wheat crop. The NDVI indicate that winter crops failed to recover in Stavropol and Volgograd.

Winter grains in the oblasts of the southern Central District have benefited from recent rainfall and are generally good condition, except for the drier oblast in the east including Voronezh and Tambov. In the oblasts west of Voronezh (for example, Belgorod and Kursk), NDVI indicate improving conditions as of June 17 and suggest average or above-average potential yield. Above-average winter-grain yields are expected in the Volga District due to generally favorable weather to date, with the exception of Saratov where NDVI indicate a recent deterioration in winter-crop conditions.

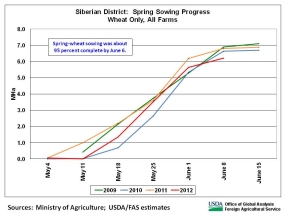

Ministry of Agriculture reports indicate that spring-wheat planting was about 95 percent complete by June 6. Sown area stood at 12.8 million hectares against 13.7 million by the same date last year. The Siberian, Volga, and Ural Districts together account for over 90 percent of Russia’s spring-wheat output. The month of May was very dry in Russia’s main spring-wheat zone, which extends from the Volga Valley to western Siberia. The first half of June brought modest relief to parts of the region, and final yield will depend largely on June and July precipitation. (The current USDA wheat-production forecast assumes average weather for the remainder of the growing season.) Ministry of Agriculture reports indicate that spring-wheat planting was about 95 percent complete by June 6. Sown area stood at 12.8 million hectares against 13.7 million by the same date last year. The Siberian, Volga, and Ural Districts together account for over 90 percent of Russia’s spring-wheat output. The month of May was very dry in Russia’s main spring-wheat zone, which extends from the Volga Valley to western Siberia. The first half of June brought modest relief to parts of the region, and final yield will depend largely on June and July precipitation. (The current USDA wheat-production forecast assumes average weather for the remainder of the growing season.)

Barley and Corn Area Increase

Barley production is forecast at 15.1 million tons from estimated harvested area of 8.2 million hectares. Spring barley typically accounts for 85 to 90 percent of total barley output in Russia. Spring barley is grown in every grain-producing region in Russia, but about 60 percent of the spring barley is grown in the Central and Volga Districts. As of June 6, spring barley was planted on 8.1 million hectares against 7.2 million by the same date last year. Planting was complete in the Central District, and nearly complete in the Volga District where sown area has already surpassed the official forecast by 10 percent. Planting in the Ural and Siberian Districts likely will be nearly complete by mid-June. Most of Russia’s winter barley is grown in Krasnodar and Stavropol territories in Southern Russia. Bitterly cold February weather reportedly destroyed a significant portion of the crop, but due to winter barley’s low planted area (relative to spring barley) this will not have a substantial impact on total barley output.

Corn planting is on a pace to reach the highest sown area in about fifty years. Planted area is reported at 1.9 million hectares, exceeding the official forecast of about 1.8 million. Typically about 10 percent of the planted area is not harvested for grain, usually because of excessive heat or dryness in some region of the production zone. The USDA forecasts 2012/13 corn output at 7.8 million tons. Corn is grown mainly in southern Russia, which is subject to occasionally excessive heat and dryness. Although yield can fluctuate significantly from year to year, depending on the weather, yield has increased substantially since 2001 due to a steady improvement in technology, including the use of hybrids. The forecast yield of 4.11 tons per hectare is the second-highest on record.

Sunflower Area Remains High

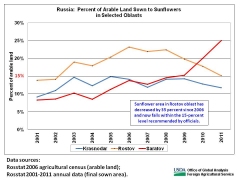

Russia's sunflower area has doubled since 2001. Agricultural officials have long maintained that sunflowers should not be planted in the same field more frequently than once every seven to ten years. The main reason for the recommended restrictions against sunflower planting is to prevent the establishment and spread of soil-borne fungal diseases, chiefly phomopsis and sclerotinia. Chemical control is difficult and expensive, so farmers in Russia typically rely on the use of long rotations. Farm directors indicate that too-frequent sunflower planting can result in another serious problem, especially in dry regions like Volgograd oblast: infestation by the weed zarazikha (broomrape), which attaches itself like a parasite to the roots of the sunflower plant. The traditional method in Russia for controlling this weed is to not plant sunflowers for ten to twelve years, but zarazikha can also be eradicated with the use of an expensive herbicide. Russia's sunflower area has doubled since 2001. Agricultural officials have long maintained that sunflowers should not be planted in the same field more frequently than once every seven to ten years. The main reason for the recommended restrictions against sunflower planting is to prevent the establishment and spread of soil-borne fungal diseases, chiefly phomopsis and sclerotinia. Chemical control is difficult and expensive, so farmers in Russia typically rely on the use of long rotations. Farm directors indicate that too-frequent sunflower planting can result in another serious problem, especially in dry regions like Volgograd oblast: infestation by the weed zarazikha (broomrape), which attaches itself like a parasite to the roots of the sunflower plant. The traditional method in Russia for controlling this weed is to not plant sunflowers for ten to twelve years, but zarazikha can also be eradicated with the use of an expensive herbicide.

Officials urge that sunflower area not exceed 15 percent of the total arable land, but sunseed is a consistently profitable crop and adherence to the mandate varies by region. Officials in Krasnodar, for example, exert a fairly high level of influence over planting decisions and closely monitor sunflower area. Control tends to be looser in other territories, and data from Rosstat indicate that sunflower area exceeds the recommended level of 15 percent of arable land in several of Russia’s top sunflower-growing oblasts. Despite the likely negative impact on yield resulting from the over-expansion of sunflower planting in some oblasts, Russian sunseed yield has benefited from the same growth in agricultural technology that has boosted corn yield. Sunseed yield has increased by about 50 percent since 2001 due in large part to the greater use of hybrids. The USDA forecasts Russian sunseed output for 2012/13 at 8.5 million tons, down 12 percent from last year. The year-to-year drop is based mainly on lower estimated yield, which is forecast at 1.21 tons per hectare, down 9 percent from last year’s 22-year high.

Record Area for Spring Rape and Soybeans

Local specialists reported that a large share of Russia’s sown winter-rape area was destroyed by February frost in Krasnodar and Stavropol territories, where nearly all of the country’s winter rape is grown. According to one private analyst who conducted extensive field surveys in the region, 70 percent of the winter rape was simply plowed under. A 25-percent increase in estimated spring-rape area, however, will likely compensate for the winter-rape losses, and total rapeseed production is forecast to nearly match last year’s record level. Total rapeseed production for 2012/13 is forecast at 1.0 million tons, 5 percent below last year, and harvested area is estimated at a record 0.9 million hectares.

Soybean area and yield have both increased significantly over the past ten years. About two-third of Russia’s soybeans are grown in the Far East District but area has jumped also in the Southern and Central Districts in European Russia. Planting progressed at a brisk pace this year and by June 6 had already reached 90 percent of the official forecast of nearly 1.4 million hectares. Based on estimated planted area of 1.35 million hectares and an average rate of abandonment, harvested area is forecast at 1.2 million hectares, slightly surpassing last year’s record level. Output is forecast at a record 1.8 million tons with forecast yield matching last year’s record of 1.48 tons per hectare.

The valuable contribution of Yelena Vassilieva, USDA/FAS agricultural specialist in Moscow, is gratefully acknowledged. Current USDA area and production estimates for grains and other agricultural commodities are available at PSD Online.

|