Ukraine: Wheat Prospects Remain Favorable

Early-May prospects for 2013/14 wheat production in Ukraine remain generally favorable despite recent dryness. The crop benefited from outstanding establishment conditions in the fall and unusually low frost damage during the winter. Subsoil moisture reserves were at or near capacity when winter crops resumed vegetative growth in the spring, and current moisture levels are adequate except for areas of localized dryness in south-central Ukraine and extreme eastern Ukraine. Final winter-crop yields will hinge largely on weather during the remainder of May. The USDA estimates total wheat production at 22.0 million tons compared to 15.8 million last year. Record output is estimated for corn and sunflowerseed due to a forecast rebound in yield, but late planting is expected to reduce spring-barley yield this year and total barley production is forecast at a below-average level for the second consecutive year.

Personnel from the USDA Foreign Agricultural Service (FAS) conducted crop-assessment travel in central and southern Ukraine during mid-April. The team examined field conditions and met with grain and oilseed producers, agricultural officials, and private commodity analysts. The team’s observations confirmed evidence from satellite-derived vegetation indices indicating better-than-normal conditions for winter crops in most of the important wheat-producing territories.

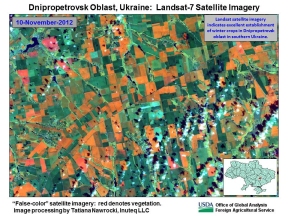

Winter Grains: According to data from the State Statistical Committee of Ukraine, the area planted to winter crops last fall was similar to the previous year. Wheat was reportedly sown on 6.70 million hectares (against 6.71 million for 2012/13), barley on 1.10 (1.37) million, rye on 0.30 (0.32) million, and rape on 1.03 (0.96) million. The sowing campaign was completed without delay and abundant surface moisture during October and November resulted in crop establishment conditions that were remarkably better than last season, as indicated by Landsat imagery, with the exception of two pockets of persistent dryness in south-central and southeastern Ukraine. [View larger images for November 2011 and November 2012.] Winter crops entered dormancy in good condition and a blanket of protective snow cover prevented frost damage to the crops during an episode of bitterly cold weather in mid-December. [View Ukraine winter-crop assessment reports from November and March.] Winter Grains: According to data from the State Statistical Committee of Ukraine, the area planted to winter crops last fall was similar to the previous year. Wheat was reportedly sown on 6.70 million hectares (against 6.71 million for 2012/13), barley on 1.10 (1.37) million, rye on 0.30 (0.32) million, and rape on 1.03 (0.96) million. The sowing campaign was completed without delay and abundant surface moisture during October and November resulted in crop establishment conditions that were remarkably better than last season, as indicated by Landsat imagery, with the exception of two pockets of persistent dryness in south-central and southeastern Ukraine. [View larger images for November 2011 and November 2012.] Winter crops entered dormancy in good condition and a blanket of protective snow cover prevented frost damage to the crops during an episode of bitterly cold weather in mid-December. [View Ukraine winter-crop assessment reports from November and March.]

Satellite-derived vegetative indices (NDVI) indicated that winter grains in most parts of southern and eastern Ukraine were in above-average condition in early April, prior to the widespread resumption of vegetative growth, while significant portions of northern and western Ukraine were still under snow cover as late as early April. Crops initially broke dormancy in early March in southern Ukraine but periodic cool weather repeatedly interrupted vegetative growth. Despite the stumbling start, winter crops were in unusually good shape by mid-April. The FAS team observed outstanding winter-crop conditions throughout southern Ukraine, including Zaporizhia oblast where surface moisture was scant throughout the fall and where FAS specialists expected to find evidence of poor winter-crop establishment. Farmers in this area reported, however, that occasional timely showers provided just enough moisture for winter crops to emerge and become well established. Crop conditions were similarly good in central Ukraine (including Dnipropetrovsk, Kirovograd, and Cherkassy oblasts). An agricultural specialist in southern Ukraine who monitors crop conditions throughout the country reported that this year’s April winter grain conditions were the best in five years, including in Kherson and Crimea. Crops in north-central Ukraine resumed vegetative growth by around April 10, roughly two to three weeks later than normal, but were more well-developed than at the same time last year, with denser stands and a greater number of productive tillers.

At the end of April, NDVI were still above average in the steppe zone of southern and eastern Ukraine. In northern and central Ukraine, meanwhile, vegetative indices were largely below normal. Considering the late spring, the low NDVI could reasonably be attributed in part to the delayed resumption of vegetative growth – by as much as three weeks in parts of northern Ukraine. In some areas, however, according to researchers at the Bila Tserkva Wheat Selection Institute, the combination of persistent snow cover over unfrozen soil contributed to a high incidence of fungal disease, particularly fusarium, and the weakening of winter crops resulting from continued transpiration beneath the snow. Much of this damage, however, was top-kill only; the growing point was not damaged and the plants will recover. In parts of northeastern Ukraine, the low NDVI likely reflect damage resulting from ice crusting. According to specialists at the Hydromet Center of Ukraine, winter conditions in northeastern Ukraine were conducive to the formation of a persistent ice crust that may have caused damage to winter crops. Ice crusts typically develop under conditions of repeated freezing and thawing which enables a lens of ice to form on or beneath the surface. Winter crops are subject to suffocation if the crust remains in place for over thirty days. In Chernihiv and Sumy oblasts localized crusting reportedly persisted for over three months. The full extent of damage is currently being assessed and final winterkill data will be available in July.

Farmers did not express undue concern to FAS personnel about the direct impact of the late spring on the potential yield of winter crops. Most farmers, however, strongly emphasized the benefit of a gradual transition from spring weather to summer weather and voiced the customary warnings about the yield reduction that could occur in the event of a sudden arrival of excessive heat. Average daily temperatures in late April and early May have indeed been above average but not excessively high, and lower than during the same time last year. This year's winter grains benefited greatly from the outstanding autumn conditions, which enabled the crops to develop four to five productive tillers prior to entering dormancy. Subsurface moisture reserves have fallen more rapidly than usual in recent weeks due to below-normal precipitation but have not reached alarmingly low levels. The high initial subsurface moisture levels will compensate to some degree for the low precipitation in April. As usual, the final yield of wheat and other winter crops will depend largely on May weather. The current USDA wheat-production forecast of 22.0 million tons is based on conditions to date and the assumption of normal weather during the remainder of the growing season. Crop conditions will be monitored throughout the growing season and estimates will be revised if necessary.

Barley: The planting of early spring grains (barley, oats, and wheat) proceeded at an unusually slow pace this season. By the end of the first week of April, only about 27 percent of the planned area had been sown compared to the five-year average of 53 percent. Analysis of planting-progress and yield data indicates that years in which early spring grain planting was delayed are also marked by low spring-barley yields. Farmers and other specialists in Ukraine attribute this to two factors. First, if crops are planted late they do not have adequate time to fully develop secondary roots, and plants will be less capable of extracting water from the subsoil regardless of the moisture conditions. Second, late planting increases the risk of exposure to unfavorably high temperatures later in the growing season. Spring barley usually accounts for two-thirds to three-quarters of Ukraine’s total barley production. For 2013/14, the expected below-normal yields for spring barley will be offset by likely above-average yields for winter barley. Winter barley is grown mainly in south-central Ukraine, and the good conditions observed by the FAS team in Odessa, Mikolaiv, and Kirovograd will compensate for the poorer conditions in Crimea. The USDA forecasts total barley output for 2013/14 at 7.0 million tons, against the 5-year average of 9.8 million, from estimated harvested area of 3.2 million hectares. Yield is forecast at 2.11 tons per hectare, up 4 percent from last year but 8 percent below the 5-year average. This year’s projected harvest is only about 0.1 million tons above last year, when severe fall drought destroyed a large portion of the winter barley area.

Corn: Although this year’s low winter-crop losses will result in fewer hectares available for spring crops, this is unlikely to restrain the recent growth in corn area. In the words of one private commodity analyst in Kiev, corn has its own place in the rotation. The USDA estimates harvested area at a record 4.7 million hectares (from estimated sown area of 4.8 million), up 0.3 million last year and surpassing the previous record of 4.5 million in 1963/64. Corn remains a very attractive crop in Ukraine due to high domestic consumption -- driven in part by expanding poultry production -- and the crop’s attractiveness as an export commodity. Detailed data from private commodity analysts indicate that corn has been the most profitable grain crop in Ukraine in recent years, especially in the northern and central regions. (Sunflowerseed is the most profitable of all crops, and has been for over ten years.) Although the per-hectare cost of production for corn is the highest of all grain and oilseed crops, the per-ton cost is among the lowest due to corn’s high yield potential. A steady increase in the level of technology, specifically the expanded use of imported hybrid seed, has been driving an increase in corn yield for over ten years. Seed-corn imports have increased four-fold since 2005, with the majority of imports coming from Hungary, Romania, and France, and the level of planted corn area in Ukraine is strongly linked to the level of imports. Yield for 2013/14 is forecast at 5.53 tons per hectare, second only to 6.44 tons per hectare for 2011/12, and output is forecast at a record 26.0 million tons, up 5.1 million from last year. Corn planting was about half finished by the beginning of May and will be largely complete by the end of the month. Corn: Although this year’s low winter-crop losses will result in fewer hectares available for spring crops, this is unlikely to restrain the recent growth in corn area. In the words of one private commodity analyst in Kiev, corn has its own place in the rotation. The USDA estimates harvested area at a record 4.7 million hectares (from estimated sown area of 4.8 million), up 0.3 million last year and surpassing the previous record of 4.5 million in 1963/64. Corn remains a very attractive crop in Ukraine due to high domestic consumption -- driven in part by expanding poultry production -- and the crop’s attractiveness as an export commodity. Detailed data from private commodity analysts indicate that corn has been the most profitable grain crop in Ukraine in recent years, especially in the northern and central regions. (Sunflowerseed is the most profitable of all crops, and has been for over ten years.) Although the per-hectare cost of production for corn is the highest of all grain and oilseed crops, the per-ton cost is among the lowest due to corn’s high yield potential. A steady increase in the level of technology, specifically the expanded use of imported hybrid seed, has been driving an increase in corn yield for over ten years. Seed-corn imports have increased four-fold since 2005, with the majority of imports coming from Hungary, Romania, and France, and the level of planted corn area in Ukraine is strongly linked to the level of imports. Yield for 2013/14 is forecast at 5.53 tons per hectare, second only to 6.44 tons per hectare for 2011/12, and output is forecast at a record 26.0 million tons, up 5.1 million from last year. Corn planting was about half finished by the beginning of May and will be largely complete by the end of the month.

Sorghum: The USDA now publishes production and trade estimates for Ukraine sorghum. (The series begins with the 2007/08 marketing year.) Sorghum is one of the more drought-resistant grains and it is a suitable crop for southern Ukraine, which is which is subject to frequent dryness and is where nearly all of the country’s sorghum is grown. Sorghum is chiefly an export crop; it is suitable for use as feed for dairy cattle as a substitute for silage corn but there is little consistent domestic demand. Since sorghum is one of the later-planted spring grains, it can be planted in fields in which winter crops have been destroyed by drought or frost. The low winter-crop losses for 2013/14 is the main reason for the estimated 25-percent year-to-year drop in sorghum area. Production is forecast at 250,000 tons, up 20 percent from last year. Yield dipped sharply in 2012/13, to 1.52 tons per hectares, but is forecast to rebound to 2.08 tons per hectare, roughly matching the 5-year average.

Oilseeds: The USDA forecasts 2013/14 sunflowerseed output at 10.5 million tons, matching the estimated record output of 10.5 million for 2011/12. Harvested area is estimated at 6.0 million hectares, unchanged from last year’s level. Planting was about two-thirds complete as of May 1. Sunseed is routinely cited by grain and oilseed producers as the most profitable crop in Ukraine, and this is confirmed by data from the State Statistical Committee of Ukraine. Because sunseed is a consistently lucrative crop, the planted area has been increasing fairly steadily over the past 15 years, although area may be limited slightly this year because the unusually low level winter-crop losses has reduced the area available for the planting of spring crops. Government agricultural specialists typically recommend that sunflowers be planted in the same field no more than once every seven years in order to prevent the occurrence of soil-borne fungal diseases. Private commodity analysts almost universally agree, however, that due to the crop’s high profitability many farmers ignore the rotational constraints and increase the frequency of sunflowers in the rotation. A large share of the “excess” area is not officially reported by farmers so that they can be viewed as complying with the State-sanctioned rotational guidelines. Actual area likely exceeds reported area by as much as one million hectares in some years. Despite the widespread practice of pushing the rotation, estimated sunseed yield has shown a strong positive trend since 2001 which is largely attributed to the increased use of hybrid seed. (Yield dropped sharply in 2012 due to excessive heat during a critical growth stage.) Yield for 2013/14 is forecast at 1.75 tons per hectare, slightly below the 2011/12 record of 1.81 t/ha but 10 percent above the 5-year average.

The outlook for Ukraine’s other main oilseed crops is favorable as well. Lower-than-average winterkill and generally good spring conditions will benefit the 2013/14 rapeseed crop. The FAS team observed much better winter-rape conditions in 2013 than during the previous year. Output is forecast at 2.0 million tons, second only to the 2.9-million-ton harvest of 2008/09. Winter rape accounts for over 90 percent the country’s total rape output. Most of the rapeseed produced in Ukraine is exported directly as seed to the European Union. In terms of profitability, rapeseed is an erratic crop. According to a specialist in southern Ukraine, rapeseed has the potential to be the most profitable crop in the rotation if the weather is ideal, but this happens about once every five years. Sown area has retreated from the record level of five years ago but has stabilized at about 1 million hectares. Soybean area, meanwhile, has almost tripled in the past five years. Production has increased from less than 100,000 tons in 2001 to a forecast 3.0 million tons for 2013/14 in response to the growth of the poultry industry and, more importantly, a phenomenal jump in exports over the past three years. Harvested area for 2013/14 is estimated at a record 1.5 million hectares and production at a record 3.0 million tons. The outlook for Ukraine’s other main oilseed crops is favorable as well. Lower-than-average winterkill and generally good spring conditions will benefit the 2013/14 rapeseed crop. The FAS team observed much better winter-rape conditions in 2013 than during the previous year. Output is forecast at 2.0 million tons, second only to the 2.9-million-ton harvest of 2008/09. Winter rape accounts for over 90 percent the country’s total rape output. Most of the rapeseed produced in Ukraine is exported directly as seed to the European Union. In terms of profitability, rapeseed is an erratic crop. According to a specialist in southern Ukraine, rapeseed has the potential to be the most profitable crop in the rotation if the weather is ideal, but this happens about once every five years. Sown area has retreated from the record level of five years ago but has stabilized at about 1 million hectares. Soybean area, meanwhile, has almost tripled in the past five years. Production has increased from less than 100,000 tons in 2001 to a forecast 3.0 million tons for 2013/14 in response to the growth of the poultry industry and, more importantly, a phenomenal jump in exports over the past three years. Harvested area for 2013/14 is estimated at a record 1.5 million hectares and production at a record 3.0 million tons.

Technology: The use of mineral fertilizers has been increasing steadily for over ten years, and the higher application rates have likely contributed to a concurrent increasing trend in wheat yield. Although the government is providing no direct subsidies to grain and oilseed producers this year, Ministry of Agriculture reports and private commodity analysts indicate that mineral-fertilizer application will increase again this year.

Not surprisingly, yields of wheat and other major crops are significantly higher on larger and presumably more affluent farms, including enterprises operated by large agro-holding companies. Larger enterprises are more capable of affording basic agricultural inputs and more advanced technology, including adequate mineral fertilizer and plant-protection chemicals, hybrid seed, and advanced (i.e., imported) planting and harvesting equipment. According to data from the State Statistical Committee, the average wheat yield on agricultural enterprises over 3,000 hectares in size is double the yield from enterprises below 50,000 hectares in size. The trend is similar for Ukraine’s other major crops, including corn and sunflowers.

The valuable contribution of Yuliya Dubinyuk, USDA/FAS agricultural specialist in Kyiv, is gratefully acknowledged. Current USDA area and production estimates for grains and other agricultural commodities are available on IPAD’s Agricultural Production page, or at PSD Online.

|