Southeast Asia: Post-2020 Palm Oil Outlook Questionable

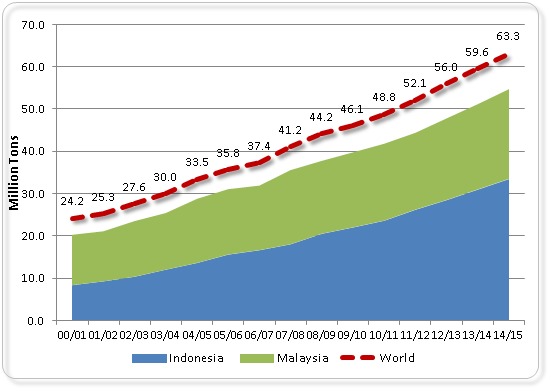

World palm oil output has steadily increased over the past few decades, reaching record levels on an annual basis. Continued expansion in Malaysia and Indonesia relies on certain factors that may be more of a challenge in the future. Given these two nations contribute roughly 86 percent of total global palm oil production, whatever affects their growth trajectory will also influence the wider international production level of this edible oil commodity. Problems that have arisen in Malaysia in the past few years (land shortage, stagnant yields) are not yet a problem in Indonesia.

Both Malaysia and Indonesia have a long history of fostering export industries and plantation crops, in particular palm oil. Both countries have ideal climates for the cultivation of this commodity, and have vastly expanded acreage. Total mature palm oil area of both countries together in 2014/15 is estimated at 13.34 million hectares. This number has nearly tripled (up 263 percent) over the past 20 years. Historically, the positive annual growth rate of palm oil production emanating from these countries was a factor of both area expansion (new acreage) and yield improvement (higher yields).

The Malaysian government announced recently that it was rapidly running out of new land to expand the palm oil industry. The Malaysian Palm Oil Board (MPOB) reported in August 2014 that it estimated the country had a maximum 1.3 million hectares of land left for palm oil, the majority of that in the state of Sarawak. However, industry observers indicate that virtually all areas easily converted to palm oil are already under cultivation, and that new land will become much more difficult to develop because of land-use suitability issues and competing legal claims to the land. It appears likely under the current domestic legal environment that Malaysian palm oil area will reach its peak by about 2020.

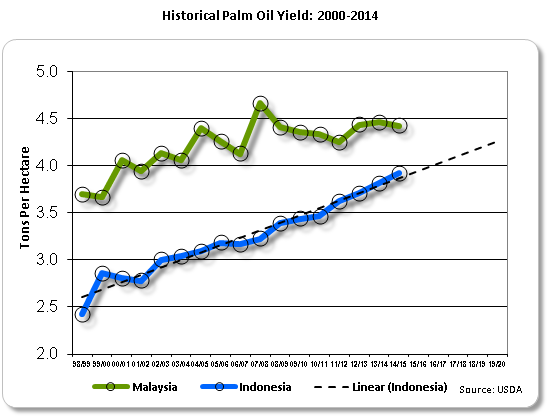

Meanwhile, over the past 7 years, Malaysian national palm oil yields have also been stagnating. This is largely a legacy of labor shortages, crop disease, and insufficient re-planting rates. Hand harvesting palm fruit in Malaysia’s hot, humid climate is relatively unattractive in Malaysia’s competitive job market. Additionally, enforcement of Malaysia’s immigration policies is limiting hiring of foreign workers. In 2014 the MPOB estimated that more than 1.5 million metric tons of palm oil production was lost on an annual basis because of a shortage of laborers to harvest the fruit. Major plant diseases (including basal stem rot, or BSR) and low yields from aging trees may also be taking a toll on production. During the replanting process, oil palm trees do not produce fruit or cash flow from harvest for approximately 3 years. Many plantations delay the clearing of old stands despite agronomic recommendations to replant after 25 years. Though the government has plans to deal with these entrenched problems, rapid improvement is not expected. A more in-depth discussion of these problems is available in, Malaysia: Stagnating Palm Oil Yields Impede Growth, published in 2012.

As illustrated in the graph above, palm oil yields in Indonesia are likely reach the level of yields in Malaysia by 2020. At the same time, area expansion in Malaysia will essentially cease, leaving it with a fixed production base. Indonesia uses similar technology to Malaysia, but Indonesia has potential assets and strengths that may help mitigate Malaysia’s production decline, helping regional output to remain steady.

Indonesia can technically continue to expand area at current historical rates (approximately 400,000 hectares per year) for many years, though logically there will be limits imposed at some point in the future. As far as factors affecting crop yield, Indonesia has a practically inexhaustible supply of domestic labor – both professional and field workers. Therefore, un-harvested and un-processed fruit should not become a major problem. In addition, a much larger percentage of Indonesia’s oil palm trees are either immature (less than 3 years old) or are below the 25-year threshold when re-planting is recommended. This underpins the national average yield, as a significant percentage of the national crop is experiencing rapid yield growth. Newer cultivars are also generally higher yielding than those planted a decade ago, so there is some built-in stability for yield improvement.

On balance, Indonesia should be able to continue to grow at near historic rates, both in terms of area expansion and yield, for the foreseeable future. However, the impact of plateauing production in Malaysia could have a potential moderating impact on regional production.

This report has been published by the Office of Global Analysis (OGA), International Production Estimates Division (IPAD). FAS agricultural attaché reports can be queried at the FAS web site (http://gain.fas.usda.gov). USDA global area and production estimates for grains and other agricultural commodities are available on the USDA/FAS Global Crop Production Analysis page, or at PSD Online (http://apps.fas.usda.gov/psdonline/). And global crop condition maps and analysis can be found at FAS’s Crop Explorer (http://www.pecad.fas.usda.gov/cropexplorer).

|