Ukraine: Improving Prospects for 2015/16 Winter Wheat

Production prospects for Ukraine’s 2015/16 wheat crop have improved substantially since last fall, when severe dryness hampered the crop’s emergence and establishment. Spring rains provided much-needed moisture for winter crops as they broke dormancy and resumed vegetative growth. USDA forecasts wheat output at 23.0 million tons, down 7.1 percent from last year’s bumper harvest but 13 percent above the 5-year average. Both large agricultural enterprises and small farms are facing sharply higher prices for agricultural inputs (especially imported seed and agrichemicals), while commercial interest rates are approaching 30 percent. Crop producers are responding in a variety of ways in order to minimize the impact of the high prices and maintain acceptable yields, including substituting cheaper but less effective domestic products and reducing application rates for mineral fertilizer.

Winter wheat, which accounts for about 98 percent of Ukraine’s total wheat output, was sown on a reported 7.1 million hectares, up about 0.7 million from last year. (All USDA estimates for Ukraine include estimated area and output for Crimea.) Planting was delayed during September due to the dry soil conditions but accelerated in October – even through the dryness lingered – and the final sown area for winter wheat reached the highest level in over 10 years. Winter wheat, which accounts for about 98 percent of Ukraine’s total wheat output, was sown on a reported 7.1 million hectares, up about 0.7 million from last year. (All USDA estimates for Ukraine include estimated area and output for Crimea.) Planting was delayed during September due to the dry soil conditions but accelerated in October – even through the dryness lingered – and the final sown area for winter wheat reached the highest level in over 10 years.

Microwave satellite imagery for the month of October 2014 indicates the severe lack of surface moisture for the fall-sown winter crops. Surface wetness was well below normal in nearly every territory of Ukraine other than the Crimean peninsula, and the impact of the dryness is evident in satellite-derived vegetative indices (NDVI) from early November, prior to the onset of dormancy.

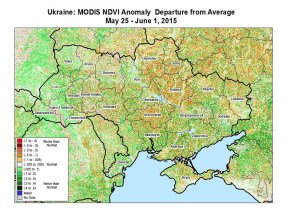

Precipitation during March and April replenished depleted soil moisture and enabled winter crops to compensate in part for the extremely dry fall, and NDVI indicate an improvement in winter-crop conditions between mid-April and the end of May. Vegetative vigor is still lower than last year when wheat yield reached a 25-year high, but conditions have rebounded remarkably well since winter crops resumed vegetative growth in March.

During interviews conducted by specialists from the USDA Foreign Agricultural Service in April, Ukrainian farmers and commodity analysts indicated that overall fertilizer application in Ukraine will almost certainly decrease this year, but not by a large amount. According to a survey conducted by one of the country’s top commodity analysts, about half of the farmers will reduce fertilizer application in order to save money. The depth of the reductions will vary greatly: as much as 30 percent on some farms but minimal on others. Prices for mineral fertilizer have increased by nearly 15 percent from last year, and since fertilizer typically is the largest component of the total cost of production for wheat, many farmers view reduced fertilizer use as the best way to cut overall production costs.

Prices of imported agrichemicals, meanwhile, have increased by approximately 40 percent from last year’s levels. Despite the higher prices, total Ukrainian imports of herbicides, insecticides, and fungicides from September through March are up 6 percent from last year. Assuming that the majority of agrichemical imports are actually purchased and applied by farmers during the 2015 crop season, the stable year-to-year application of chemicals would be consistent with farmers’ announced intentions to save money chiefly by reducing fertilizer use.

Data from the State Statistical Committee of Ukraine indicate that the area sown to spring barley in 2015 dropped by 14 percent from last year, to 1.54 million hectares. Spring barley typically comprises about two-thirds of Ukraine’s total barley output. The year-to-year decrease in sown area is attributable in part to wet April weather, which impeded the planting of barley and other early spring grains. At the end of March the Ministry of Agrarian Policy and Food was forecasting only a 2-percent decrease in spring barley area; farmers viewed barley as a reasonably attractive spring-crop option based on its high price (relative to other years) and low cost of production. By the end of April, however, with the planting window closing for spring barley, many farmers decided to instead plant sunflowers, which are one of Ukraine’s most consistently profitable crops.

Winter barley was sown last autumn on a reported 1.2 million hectares, about the same level as last season, but nearly half of the crop was planted in the three Ukrainian territories where the fall dryness was most severe. As a result, a considerable portion of the sown area of winter barley failed to survive.

Total barley production for 2015/16 is forecast at 6.0 million tons, down about 3.4 million from last year due to a 22-percent decrease in estimated area and a 19-percent decrease in the forecast yield.

Corn area for 2015/16 is estimated to drop from last year’s level because of reduced profitability relative to sunflowers and soybeans. USDA estimates area at 4.3 million hectares, against 4.6 million last year, based on planting reports from the Ministry of Agrarian Policy and Food. Planting was essentially complete by the end of May.

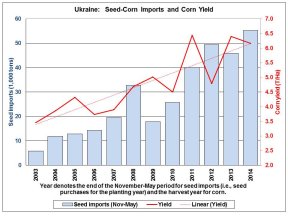

The use of hybrid corn seed, both imported and domestic, has been behind a strong increase in yield over the past 10 years. Private commodity analysts estimate that imported hybrids accounted for approximately 60 to 70 percent of the total planted corn area in Ukraine last year, but the use of imported seed for the 2015 planting season is likely to decrease from last year’s level due to a sharp increase in prices. According to data from the Global Trade Information Service, hybrid corn-seed imports from September through March were down 43 percent from the same time period last season, and down about 20 percent from the two previous years. Many agricultural enterprises will substitute domestic hybrids for the more expensive imported seed, but this does not necessarily imply a large drop in yield for the 2015 crop. A specialist for a major U.S. seed company with seed-processing facilities in Ukraine maintains that if weather during the growing season is generally favorable, the difference in yield between domestic and imported hybrids is not substantial. The big advantage in using imported hybrids occurs in years of significant temperature- or drought-related stress. Based on the assumption of average weather throughout the growing season, USDA forecasts 2015/16 corn output at 26.0 million tons, against 28.5 million last year. Yield is forecast at 6.05 tons per hectare, 6.9 percent above the 5-year average. The use of hybrid corn seed, both imported and domestic, has been behind a strong increase in yield over the past 10 years. Private commodity analysts estimate that imported hybrids accounted for approximately 60 to 70 percent of the total planted corn area in Ukraine last year, but the use of imported seed for the 2015 planting season is likely to decrease from last year’s level due to a sharp increase in prices. According to data from the Global Trade Information Service, hybrid corn-seed imports from September through March were down 43 percent from the same time period last season, and down about 20 percent from the two previous years. Many agricultural enterprises will substitute domestic hybrids for the more expensive imported seed, but this does not necessarily imply a large drop in yield for the 2015 crop. A specialist for a major U.S. seed company with seed-processing facilities in Ukraine maintains that if weather during the growing season is generally favorable, the difference in yield between domestic and imported hybrids is not substantial. The big advantage in using imported hybrids occurs in years of significant temperature- or drought-related stress. Based on the assumption of average weather throughout the growing season, USDA forecasts 2015/16 corn output at 26.0 million tons, against 28.5 million last year. Yield is forecast at 6.05 tons per hectare, 6.9 percent above the 5-year average.

Farmers consistently cite sunflowers as the most reliably profitable crop in Ukraine, but the planting frequency for sunflowers is limited by rotational constraints. Farmers are reluctant to plant sunflowers in the same field more frequently than once every four to six years. Sunflowers have a deep rooting system which enables the crop to effectively extract moisture and nutrients from the soil but also depletes subsoil moisture reserves for subsequent crops. Frequent planting of sunflowers can also lead to soil-borne fungal diseases. The fertility and disease issues can be addressed with mineral fertilizer and fungicides but these added inputs would increase the cost of production, so the majority of producers observe the rotation recommended by agronomists. USDA estimates harvested area for 2015/16 at 5.3 million hectares, matching the level of the previous two years.

Like corn, Ukraine sunseed has enjoyed a hybrid-driven yield increase over the past ten years. Yield has essentially doubled since 2004, when hybrid imports began to steadily increase. The Global Trade Information Service reports that hybrid sunflower seed imports for October through March were down 29 percent from last year, but (also like corn), farmers are likely to compensate for lower imports through the increased use of domestic hybrids. USDA forecasts yield at 1.89 tons per hectare, 2.0 percent below last year but 4.1 percent above the 5-year average. Production is forecast at 10.0 million tons, down 0.2 million from last year.

Ukraine soybean area has doubled over the past five years, and USDA estimates that continued expansion for 2015/16 will drive estimated output to a record 4.4 million tons, surpassing last year's harvest by 13 percent. Area is estimated to increase by 11 percent from last year, to a record 2.0 million hectares. The increase is attributed to high profitability relative to other spring crops, strong domestic demand from the poultry and livestock sector, and favorable export potential for soybeans and soy products. According to the Ministry of Agrarian Policy and Food, soybeans were planted on 2.0 million hectares as of June 9, up 0.3 million from the same date last year.

Although the planting of genetically engineered crops is officially prohibited, private commodity analysts estimate that 70 to 80 percent of Ukraine’s soybean output is from genetically engineered varieties. Farmers claim that they can plant soybeans using “saved” seed (i.e., seed from the previous year’s harvest) for as many as six years with no significant deterioration in yield.

The valuable contribution of Denys Sobolev, agricultural specialist at the USDA Office of Agricultural Affairs in Kyiv, is gratefully acknowledged.

Current USDA area and production estimates for grains and other agricultural commodities are available at PSD Online.

|