Ukraine: 2016/17 Crop Production Forecasts

Favorable weather combined with the resourcefulness and flexibility of Ukrainian crop producers has enabled the country to maintain fairly high yields for the country’s major crops over the past two years despite severe economic difficulties and social disruptions. Although wheat output for 2016/17 is forecast to drop by 12 percent from last year, the decrease is attributed chiefly to lower planted area due to excessive fall dryness. Favorable spring weather has greatly improved wheat yield prospects, and output is forecast by USDA at 24.0 million tons, down 3.3 million from last year’s crop which was the highest in 25 years. Nearly all of Ukraine’s wheat is winter wheat, and harvest will begin in late June. All USDA forecasts include estimated output from Crimea.

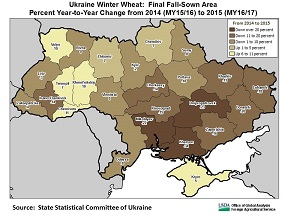

Winter-grain sowing was severely hampered by fall drought that delayed planting and reduced the final sown area. According to data from the State Statistical Committee of Ukraine, the fall-planted area of winter wheat decreased by 11 percent from last season, winter barley by 10 percent and winter rye by 12 percent. Moreover, the area where the impact of the fall dryness was most severe was the steppe zone in eastern and southern Ukraine, the country’s major wheat production region. Sown winter wheat area for 2016/17 dropped by 0.8 million hectares from last year, to 6.3 million hectares, including an estimated 0.3 million in Crimea. Moisture conditions remained unfavorable for winter-crop emergence and early establishment, and crops were still in poor condition in early November. (See February report Ukraine: 2016/17 Winter Grain Conditions.) Winter-grain sowing was severely hampered by fall drought that delayed planting and reduced the final sown area. According to data from the State Statistical Committee of Ukraine, the fall-planted area of winter wheat decreased by 11 percent from last season, winter barley by 10 percent and winter rye by 12 percent. Moreover, the area where the impact of the fall dryness was most severe was the steppe zone in eastern and southern Ukraine, the country’s major wheat production region. Sown winter wheat area for 2016/17 dropped by 0.8 million hectares from last year, to 6.3 million hectares, including an estimated 0.3 million in Crimea. Moisture conditions remained unfavorable for winter-crop emergence and early establishment, and crops were still in poor condition in early November. (See February report Ukraine: 2016/17 Winter Grain Conditions.)

Crop establishment benefited from abundant precipitation and above-average temperatures beginning in the second half of November, prior to the onset of dormancy in December. Conditions had improved substantially by the time winter crops fully resumed vegetative growth in the spring, and continued to improve throughout April. The estimated fall and winter losses were lower than initially expected; according to a report from the Ukraine Ministry of Agrarian Policy and Food (MAPF), only 2 percent of the fall-planted winter-grain area failed to survive. Yield prospects as of mid-May compare favorably to both last year and to 2014, when Ukraine wheat yield reached a near-record level. Wheat yield for 2016/17 is forecast at 3.75 tons, down 2.4 percent from last year but 8.3 percent above the 5-year average. Crop establishment benefited from abundant precipitation and above-average temperatures beginning in the second half of November, prior to the onset of dormancy in December. Conditions had improved substantially by the time winter crops fully resumed vegetative growth in the spring, and continued to improve throughout April. The estimated fall and winter losses were lower than initially expected; according to a report from the Ukraine Ministry of Agrarian Policy and Food (MAPF), only 2 percent of the fall-planted winter-grain area failed to survive. Yield prospects as of mid-May compare favorably to both last year and to 2014, when Ukraine wheat yield reached a near-record level. Wheat yield for 2016/17 is forecast at 3.75 tons, down 2.4 percent from last year but 8.3 percent above the 5-year average.

The area sown to winter crops last autumn decreased by about 1.2 million hectares, which has significantly increased the area available for the planting of spring crops. Ukraine’s main spring-planted crops are barley, sunflowers, corn, and soybeans.

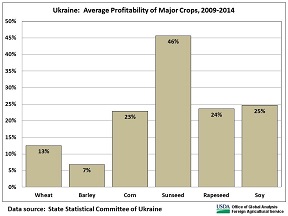

Barley is the least profitable of the four. Spring barley accounts for about two-thirds of Ukraine’s total barley area and production. Total barley area for 2016/17 is estimated at 3.1 million hectares, similar to the level of the previous four years. Output is forecast at 7.8 million tons, down 1.0 million from last year’s high-yielding crop. Roughly 40 percent of the crop is exported and another 40 percent is consumed domestically for feed. Planting was complete by the end of April and the crop will be harvested in July and August. Final yield will hinge largely on May and June weather.

Sunflowers are consistently the most profitable crop in Ukraine, and by a wide margin. (Insert link to seed-import graph.) Sunseed oil is one of Ukraine’s major agricultural exports. The planted area for sunflowers, however, is limited to some degree by rotational constraints. Frequent planting of sunflowers tends to deplete soil nutrients and subsoil moisture and can contribute to increased incidence of soil-bornefungal diseases. MAPF reports that as of May 10 sunflowers were planted on 4.2 million hectares against the forecast of 5.2 million. For the previous five years, MAPF forecasts for sunflower area have underestimated  the final sown area reported by the State Statistical Committee of Ukraine by an average of about 20 percent. USDA estimates harvested sunflower at 5.5 million hectares, matching the 2012/13 record and about 5 percent above last year’slevel. Sunseed yield has essentially doubled over the past 15 years due in large part to improved technology, including an increase in the application of mineral fertilizers and expanded use of imported hybrid seed. Total seasonal imports of hybrid sunflower seed (from October through May) decreased in 2014 and again in 2015, but imports from October 2015 through February 2016 standatarecord level and suggest that total hybrid sunflower imports for the 2016 planting season willrebound. USDA forecasts that 2016/17 sunseed output will reach a record 12.0 million tons. the final sown area reported by the State Statistical Committee of Ukraine by an average of about 20 percent. USDA estimates harvested sunflower at 5.5 million hectares, matching the 2012/13 record and about 5 percent above last year’slevel. Sunseed yield has essentially doubled over the past 15 years due in large part to improved technology, including an increase in the application of mineral fertilizers and expanded use of imported hybrid seed. Total seasonal imports of hybrid sunflower seed (from October through May) decreased in 2014 and again in 2015, but imports from October 2015 through February 2016 standatarecord level and suggest that total hybrid sunflower imports for the 2016 planting season willrebound. USDA forecasts that 2016/17 sunseed output will reach a record 12.0 million tons.

Corn area quadrupled between 2002 and 2013 but decreased over the past two years due in part to falling prices. Corn remains a popular export crop, however, and harvested area is estimated by USDA to increase slightly from last year, to 4.2 million hectares. Corn yield has benefited from a steady increase in the use of hybrid varieties, both imported and domestic. Ukraine’s imports of hybrid corn seed decreased between 2014 and 2015, and are on a pace to decrease this year as well. This is attributed to two factors: expanded production and marketing of domestically produced hybrid corn seed and, according to some farmers, a diminishing economic benefit from the use of more expensive imported seed. The likely increase in the use of domestic hybrids is expected to partly offset the drop in imports, and yield for 2016/17 is forecast to surpass the 5-year average by about 5 percent. Ukraine corn production for 2016/17 is forecast at 26.0 million tons, up 2.7 million from last year’s drought-reduced crop.

Soybean area has doubled over the past years due to increasing exports and high demand from Ukraine’s poultry industry. Output is forecast at a record 5.0 million tons. Although the planting of genetically modified crops is officially prohibited, estimates from private commodity analysts suggest that about 80 percent of Ukraine’s soybeans (and roughly 10 percent of the corn) are genetically modified. Last year, soybean area in Ukraine reached a record 2.1 million hectares, enabling the country to harvest a record 3.9 million tons despite a severe drought in the major production zone. USDA estimates that 2016/17 soybean area will surpass last year’s level by 0.2 million hectares. With yield forecast at 2.17 tons per hectare, matching the 2014/15 record, output is forecast at 5.0 million tons.

Typically, sunflower and corn planting is essentially finished by the end of May and soybean planting continues through mid-June. July and August weather will be critical in determining yields for sunflowers, corn, and soybeans. Harvest of these three crops will begin in September.

The invaluable contribution of Denys Sobolev, agricultural specialist at the USDA Office of Agricultural Affairs in Kyiv, is gratefully acknowledged. Current USDA area and production estimates for grains and other agricultural commodities are available on IPAD's Agricultural Production page or at PSD Online.

Visit Crop Explorer http://www.pecad.fas.usda.gov/cropexplorer/

|