Argentina: Wet Weather Boosts Soil Moisture but Complicates Planting Decisions

Three weeks of rainy weather prevailed in much of the core corn and soybean regions of Argentina during late October and early November. Heavy rains first arrived in La Pampa, western Buenos Aires, and southern Cordoba in late October, followed by rain in eastern Buenos Aires during the first week of November, and even later in northern Argentina. The rain slowed planting progress but recharged soil moisture reserves and could prove to be beneficial for crop development later in the growing season. According to regional planting reports, soybean planting was about 76 percent complete as of December 22 (compared to 82 percent by the same date last year) and corn planting was about 63 (69) percent complete.

With slow but steady growth in Argentina’s dairy and livestock industries, the demand for soybean meal and corn will remain high. Demand from fellow Mercosur partners (including Brazil, where wet weather also hindered planting progress), as well as demand from overseas for Argentine corn, soybeans, and processed products, will encourage the planting of both crops over the next four weeks.

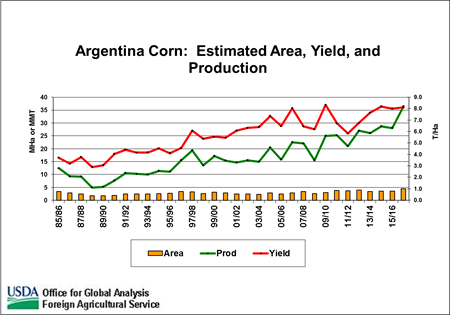

Despite the recent wet weather, USDA estimates Argentina corn area for 2016/17 at a record 4.5 million hectares (mha), and production is forecast at a record 36.5 million metric tons (mmt). Heavy late-November rains slowed corn planting progress, with early private estimates suggesting that roughly 500,000 hectares of arable land were flooded. That estimate, however, has been modified with the arrival of drier weather.

Argentine farmers tend to plant corn before the beginning or after the end of November to prevent corn pollination from occurring during the hottest time of the summer. Some farmers instead planted soybeans during November in drier areas where planting equipment could enter fields. Also, a wide planting window allows more flexibility for Argentine farmers to plant soybeans.

Currently, internal market prices in Argentina favor corn over soybeans more so than in recent years, reflecting the removal of export taxes and elimination of the quota system previously used to control corn exports. Prior to these changes, Argentina in recent years exported around two-thirds of its corn production.

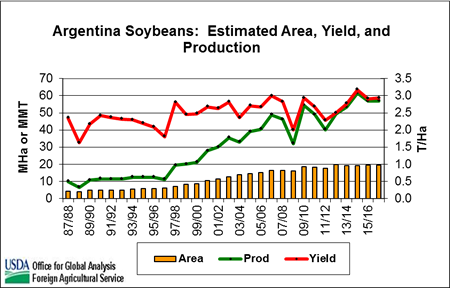

Tax-related issues, however, are likely to influence farmers’ planting decisions as well. After the government delayed plans to cut the soybean export tax by five percent throughout the country, initial Argentine planting intentions were to reduce soybean area from last year’s level. Although the government subsequently introduced tax rebates on soybeans for some provinces in the north, the lack of rebates in the core growing regions of the country has fostered a shift to alternative crops, such as corn. USDA estimates 2016/17 soybean area at 19.45 mha, nearly matching last year’s level, with production forecast at 57.0 mmt.

Figure 1. Due to weather-related planting delays and an increase in exports taxes for soybeans, planted area is unlikely to increase from last year’s level. (Source: PSD online)

Figure 2. Even with rain showers slowing the planting pace, Argentine corn area is estimated to increase this season due to ample soil moisture and seed purchases. (Source: PSD online)

Current USDA area and production estimates for grains and other agricultural commodities are available on IPAD's Agricultural Production page or at PSD Online.

Visit Crop Explorer http://www.pecad.fas.usda.gov/cropexplorer/

|