Crop Production in Greece and Italy

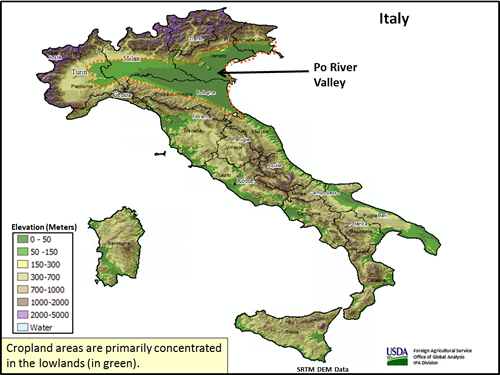

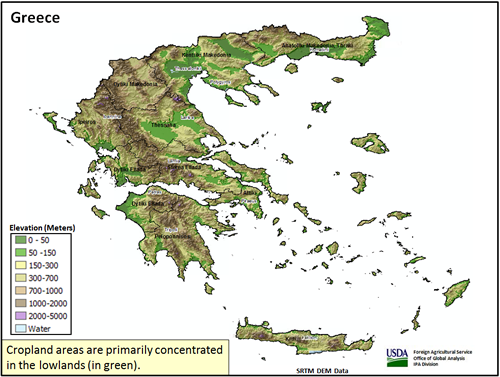

Italy and Greece are distinctive and unusual within the European Union (EU) because they both share a Mediterranean climate which enables production of a variety of crops not possible further north on the continent. Greece produces nearly 80 percent of the EU’s cotton and 9 percent of its rice. Italy produces over 50 percent of the EU’s rice and 45 percent of its soybeans. For other commodities, Italy is typically the EU’s fourth-largest corn producer and the fifth- largest wheat producer, including a significant amount of durum wheat for pasta. Greece also produces corn and wheat, but less than in Italy. Both countries have a hot and dry climate so dependence on irrigation is substantial during summer months. In June 2017, analysts from USDA’s Foreign Agricultural Service traveled to Greece and Italy to assess and examine crop conditions and conduct interviews with farmers and agricultural specialists. The team traveled along the agriculturally intensive Po River Valley of northern Italy and through several primary agricultural regions of Greece.

Rice

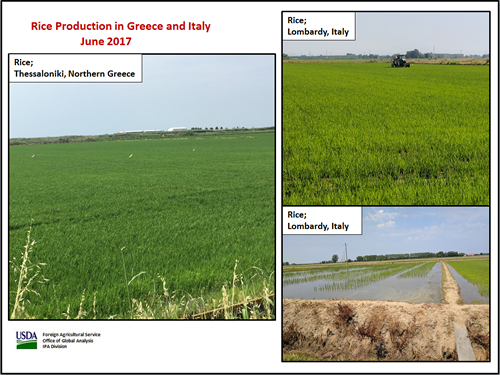

Rice production has a long history in Italy, going back hundreds of years. In the primary rice area of the Po Valley, water is usually abundant. The tributaries flowing into the Po River from the north are carrying water sourced from glaciers in the Alps. Irrigation is more prominent and more reliable on the northern side of the valley while tributaries on the southern side draw from lower mountains and a drier landscape. For this reason, water-intensive crops like corn, soybeans, and rice are grown north of the river in Piedmont, Lombardy, and Veneto, and less water-dependent crops like wheat and sunflower are dominant on the south in Emilia-Romagna. Throughout Italy, most rice is water-seeded but dry-seeding is growing in popularity. Rice area and production remain largely unchanged year-to-year. USDA estimates 2017/18 Italy milled rice production at 1.1 million metric tons (mmt).

Large-scale rice production is relatively new in Greece, where before the 1960s it wasn’t grown in the north, only in small areas in the south. Production is now concentrated along the river valleys west of Thessaloniki. Planting occurs during mid-May and harvest extends from mid-September to mid-November. Milled rice production is estimated at 0.2 mmt.

Rice area and production in both countries remain fairly stable from year to year. Cotton, corn, and alfalfa are other options available to rice farmers when making planting decisions. August and September are the critical period for rice when extreme temperatures (below 15 degrees or above 40 degrees Celsius) could cause significant damage. In recent years, farmers have transitioned to planting more of the medium grain Japonica varieties than the longer grain Indica varieties. The biggest issue facing rice farmers in both Italy and Greece is the relatively high cost of production, particularly for land. The high cost of production in the EU makes competing with cheaper imports from Asia very difficult. Beginning in 2009, several less-developed countries in Southeast Asia were permitted to export duty-free rice into the EU under the Everything but Arms agreement. Farmers often mentioned this allowance to the FAS team as being their most challenging obstacle because production costs in Europe are much higher than in Asia. Another issue facing rice farmers is the lack of allowable pesticides within the EU. The strict environmental standards have limited the range of pesticides available for use and increased the costs of those that are permitted. Rice farmers in Greece cited high taxation and current low prices for rice as negative incentives. Other price issues mentioned by farmers included high costs for inputs, including water, fuel, and fertilizer. Farmers also mentioned the environmental benefit of rice production: water pressure from the irrigated, flooded fields prevents salt water from inundating further upstream.

Cotton

Greece and Spain are the only significant EU cotton producers. USDA estimates 2017/18 Greece cotton production at 1.1 million 480-pound bales (239,000 metric tons). Cotton area for 2017/18 increased by 25 percent to 25,000 hectares due to favorable prices compared to the previous year. About 92 percent of the crop is irrigated. The cost of production for cotton is high, particularly for land, energy, and irrigation, but income from cotton has not risen in turn. Greek cotton production is protected by a complicated crop-specific payment scheme demanding that certain criteria are met. For example, cotton can be planted only on authorized land, using only certified seed. Experts estimate that one-half of the cost of cotton production is currently subsidized but agricultural initiatives are soon expected to lower the amount, making it closer to one-third of the cost of production. Cotton is viewed as a national crop and its future production is encouraged and protected in Greece.

Advantages of growing cotton include the plant’s high tolerance to heat and lower water requirements compared to corn. Greek cotton is GMO-free, the crop is mechanically produced, and farmers are very experienced in its production. Farmers have access to adequate machinery for fieldwork, and the plant population of 12 to 18 plants per square meter is reportedly the highest in the world. The biggest problem cited by contacts in the cotton industry is the lack of a designated brand for Greek cotton. Without a well-known branding to represent Greek quality, producers and ginners feel their product is not commanding as high a price as it could. Another constraint facing Greek cotton production is land fragmentation. There are many small and dispersed fields that comprise the cotton area and prevent economic efficiencies of scale. A warm climate and abundant sunshine coupled with intensive irrigation helps to stabilize and enhance Greek cotton production. Typically, the biggest potential weather problem facing cotton growers is rain in September just before harvest. This can significantly discolor the cotton, reducing quality of the lint, and reducing the yield. Occasionally a wet spring can damage newly-emerged plants, requiring re-planting.

The Greek ginning industry has become more stable after years of consolidation. There are now about five companies which account for 80 percent of the gins. Raw seed cotton is bought by ginners at harvest.

Wheat

Italy wheat production for 2017/18 is estimated at 7.2 million tons, down 1.1 million from last year’s bumper crop. Production in Greece is estimated at 1.3 million tons.

The wheat harvest occurred during June in both Italy and Greece and the results were generally positive. Dryness and heat are expected to have reduced yields in both countries during grain fill, but overall industry buyers were pleased with the results and farmers were satisfied with the harvest. Harvest was about a week to two weeks earlier than normal because of the weather. Most of the wheat in northern Italy is common wheat, but durum wheat is also grown in the region and its share of total wheat production is increasing. If producers are to grow durum in Italy’s Po Valley, the premium for durum must be significant enough to compensate for its lower yield. The majority of the durum crop is grown further south near the “heel” and the “spur” of Italy’s “boot,” in the region of Puglia. The durum crop in Puglia is harvested earlier than wheat in the Po Valley. This season, the wheat in Puglia did well due to favorable rainfall.

Durum subsidies are no longer coupled with production in the EU. The consequence has been a slow decline in durum; over the past ten years, EU durum production dropped about 25 percent. While domestic Italian pasta (made from hard or durum wheat) consumption is down, exports have increased. In Greece, durum wheat has been decreasing due to expanding barley area.

Summer Grains and Oilseeds

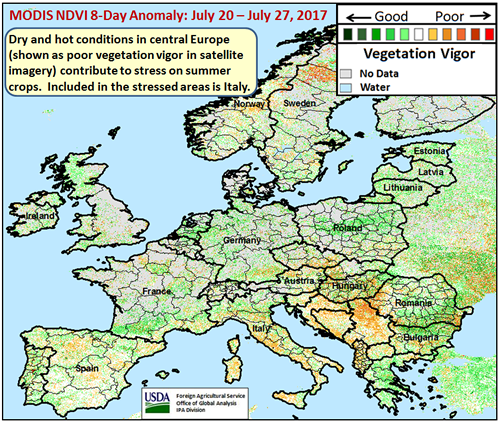

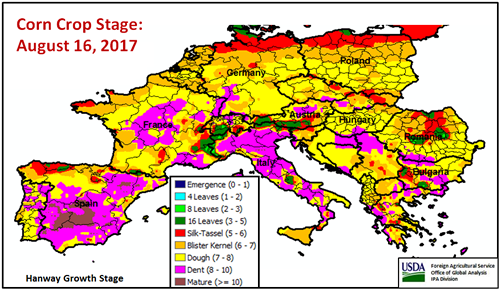

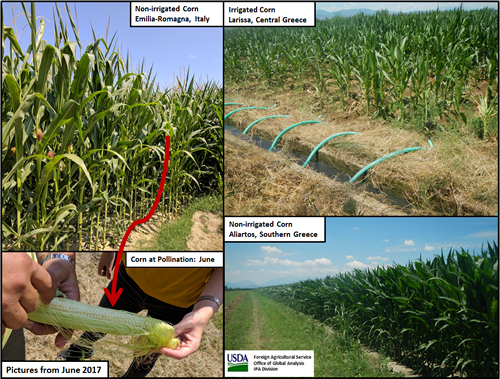

In general, summer-season crops in Italy and Greece must endure more extreme weather than autumn sown crops, causing more stress in summer crops. Seasonal dryness, especially during particularly hot summers (which has been the case in 2017) can threaten corn, sunflowers, cotton and rice, while typically cool, wetter conditions during the fall, winter, and spring benefit wheat. Irrigation was in widespread use during this summer’s visit, particularly in Greece where even during the middle of the day water was being sprayed on corn and cotton fields. Most corn in central and southern Greece and much of the crop in Italy has access to irrigation, but farmers only irrigate when rainfall is severely lacking.

Corn production in Italy for 2017/18 is estimated at 6.4 million tons, 13 percent below the 5-year average. Greece corn production is estimated at 1.1 million tons, 2 percent below the 5-year average.

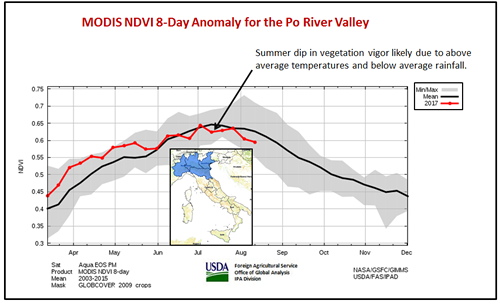

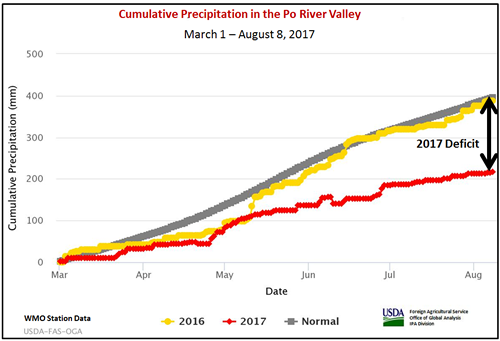

Ninety percent of Italy’s corn production and essentially all of the soybean production is in the Po Valley. Corn area in Italy has been decreasing, due primarily to relatively low prices and high cost of production. Farmers are shifting instead to soybeans, including second-crop soybeans. The EU is a protein-deficit region, so soybeans are in high demand. In Greece, due to the dry climate, 90 percent of the corn is irrigated. During hot summer months with no rain, corn is typically irrigated every 6 days. Corn in Greece is planted at the beginning of April and harvested in September and October. Typically, July and August are the most critical months as the spring-sown crops cycle through reproduction and grain-fill. Heat and dryness reduced vegetation vigor of Italy’s summer crops this season as depicted by MODIS NDVI and shown by the cumulative rainfall chart for the Po Valley.

Italy’s soybean production for 2017/18 is estimated at 1.1 million tons, up 29 percent from the 5-year average, largely due to a continuing increase in area. In the last few years sunflowerseed production in Italy has remained relatively stable at 0.25 million tons. Seventy percent of the sunflower crop in Greece is irrigated. Greek sunflowers are planted from mid-February to mid-May, and harvested in late August or September. Most are grown in northern Greece. Since olive oil is the main food oil in Greece, sunflowers are grown primarily for biodiesel production.

Italy Reference Charts

Current USDA area and production estimates for grains and other agricultural commodities are available on IPAD's Agricultural Production page or at PSD Online.

Visit Crop Explorer http://www.pecad.fas.usda.gov/cropexplorer/

|