Ukraine: Favorable Prospects for 2007/08 Wheat

Personnel from the USDA Foreign Agricultural Service conducted crop-assessment travel in the main grain and oilseed production regions of Ukraine during mid-April. The team met with farmers, agricultural officials, researchers, and independent commodity analysts in Kiev and through eastern, central, and southern Ukraine. Conditions for winter crops were observed to be very good. The spring sowing campaign has been the most rapid in recent history, and early planting typically is beneficial for spring grains. Yield prospects for all major crops remain generally favorable despite persistent spring dryness that has reduced soil moisture in many areas of Ukraine. Recent precipitation has replenished surface moisture in most areas of Ukraine, but additional rain in May and June will be necessary to recharge subsurface moisture reserves and maintain the current yield outllook.

Winter Grains: Few Ill Effects from the Mild Winter

The USDA estimates production of Ukraine wheat for 2007/08 at 17.5 million tons (against 14.0 million last year), from harvested area of 6.0 (5.5) million hectares. Winter wheat accounts for about 95 percent of total wheat output. Yield is estimated at 2.92 tons per hectare, 15 percent above last year and 14 percent above the 5-year average. Farmers expressed concern about declining soil moisture, but crops were showing no signs of moisture stress in mid-April and have received light rainfall since that time in most areas.

The team saw little evidence of either poor fall emergence or frost damage. Because of favorable fall moisture conditions and mild winter weather, winterkill (which includes losses due to both fall dryness and winter frost) is estimated to be below average. Analysts at the Ukraine Hydromet Center forecast overall winter crop losses at 6 percent. The most severe damage is reported to be in Luhansk oblast, the country’s easternmost territory, with estimated 20-percent losses due to February frost. The Hydromet Center also described losses to winter crops in southern Ukraine resulting from wind and dust storms that sheared crops at the soil surface and smothered crops with wind-blown soil. An estimated 50,000 hectares of crop land (including 30,000 hectares in Kherson territory in south-central Ukraine) were destroyed by wind-related damage.

Winter temperatures were significantly above-normal throughout Ukraine. The warm weather resulted in excessive vegetative growth of winter grains, especially on the earlier-sown fields. Plants developed three to five stems (tillers) per plant rather than the typical one to two. Secondary stems typically compete with the primary grain-producing stem for moisture and nutrients and can reduce potential yield. The excessive fall growth resulted in increased vulnerability to potential frost damage in the more northern regions. For example, a farmer in Dnipropetrovsk oblast reported that the primary stems on some early-planted fields were damaged when temperatures dropped to minus 25 degrees Celsius for two to three days; because of the advanced crop development, the temperature-sensitive growing point of early-sown plants was above ground and exposed to the cold weather. (If the growing point is damaged, the stem will not survive.) Even on plants that suffered the loss of the primary stem, however, yield reduction will be limited because the secondary stems survived and will be capable of producing grain. Late-planted fields, meanwhile, avoided frost damage because crop development was not unusually advanced and the growing point was safely beneath the soil surface, protected from the low temperatures. Winter temperatures were significantly above-normal throughout Ukraine. The warm weather resulted in excessive vegetative growth of winter grains, especially on the earlier-sown fields. Plants developed three to five stems (tillers) per plant rather than the typical one to two. Secondary stems typically compete with the primary grain-producing stem for moisture and nutrients and can reduce potential yield. The excessive fall growth resulted in increased vulnerability to potential frost damage in the more northern regions. For example, a farmer in Dnipropetrovsk oblast reported that the primary stems on some early-planted fields were damaged when temperatures dropped to minus 25 degrees Celsius for two to three days; because of the advanced crop development, the temperature-sensitive growing point of early-sown plants was above ground and exposed to the cold weather. (If the growing point is damaged, the stem will not survive.) Even on plants that suffered the loss of the primary stem, however, yield reduction will be limited because the secondary stems survived and will be capable of producing grain. Late-planted fields, meanwhile, avoided frost damage because crop development was not unusually advanced and the growing point was safely beneath the soil surface, protected from the low temperatures.

Despite the warm-weather alarms raised by observers throughout the winter, and even considering the frost damage in some regions, most farmers and specialists expect yield losses to be relatively low. The Dnipropetrovsk farmer estimates that even on his worst fields, i.e., those marked by both excessive vegetative growth and frost damage, yield losses are unlikely to exceed 20 percent (of maximum potential yield) and that these fields will still deliver 4.0 to 4.5 tons of wheat per hectare.

Some specialists, including the senior research scientist at the Ukraine Plant Breeding Institute in Odessa, maintain that the this season’s excessive vegetative growth of winter grains will have no negative effect on yield as long as crops have adequate moisture and nutrients. (The team observed favorable root development throughout central and southern Ukraine.) Even in the case of frost damage, yield loss could be as low as 5 percent because the secondary stems can compensate for the loss of the primary stem.

Outstanding April crop conditions notwithstanding, all farmers and specialists agreed that favorable May weather will be necessary to ensure high yields. A popular rule of thumb among Ukrainian farmers is that two rains in May will lead to a good wheat harvest. Farmers will also be alert to the possibility of leaf rust and other diseases. The team observed evidence of minor rust infestation on fields marked by advanced vegetative growth. The incidence of disease could intensify during the spring if chemical fungicides are not applied, but most of the larger enterprises can afford plant-protection chemicals, and the generally dry April weather helped limit the spread of rust.

Reduced Grain Quality

A more likely negative effect of the mild winter will be increased insect infestation and a resultant reduction in wheat quality. The percentage of milling quality wheat will likely be down from last year because insects were able to survive the mild winter. Bug infestation reduces gluten content, and gluten determines milling quality. In addition, fertilizer application rates are reportedly down by about 15 percent, which could also have a negative effect on quality.

Spring Barley: Beneficial Early Planting But Growing Concern About Dryness

The USDA estimates production of Ukraine barley for 2007/08 at 11.0 million tons (against 11.4 million last year). Harvested area is estimated at 4.7 (5.2) million hectares. Yield is estimated at 2.34 tons per hectare, 7 percent above last year and 10 percent above the 5-year average. Spring barley accounts for over 90 percent of total barley output in Ukraine.

The sowing of spring grains for 2007/08 advanced at the most rapid pace in recent history, due especially to warm and dry weather in March and early April. According to planting-progress data from the Ministry of Agriculture (reported by APK-Inform), the sown area of early spring grains had reached 5.2 million hectares by April 7 (including about 95 percent of the final spring barley area) compared to 1.1 million last year and about 1.6 million in 2005.

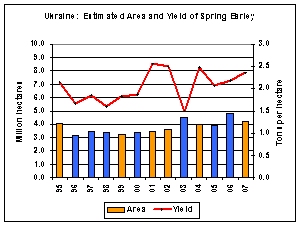

Planting and yield data over the past twelve years indicate that early planting of spring barley – the country’s chief feed grain – has a noticeably favorable effect on yield. Barley yields were above average in nearly every year marked by early completion of small-grain sowing, and below average in years of delayed planting. This makes sense, according to farmers. Late planting tends to reduce barley yield for two reasons: the root systems of late-planted barley typically fail to fully develop and potential yield is reduced regardless of subsequent weather and, because of delayed development, the crop is more likely to encounter heat and moisture stress during critical growing stages. Planting delays do not appear to result in a reduction of final planted area for barley, but rather farmers simply continue to plant beyond the optimum “window,” which likely accounts for the typically lower yields. The price of feed barley in Ukraine has increased by about 25 percent since early March and currently exceeds the prices of feed wheat and milling wheat. Planting and yield data over the past twelve years indicate that early planting of spring barley – the country’s chief feed grain – has a noticeably favorable effect on yield. Barley yields were above average in nearly every year marked by early completion of small-grain sowing, and below average in years of delayed planting. This makes sense, according to farmers. Late planting tends to reduce barley yield for two reasons: the root systems of late-planted barley typically fail to fully develop and potential yield is reduced regardless of subsequent weather and, because of delayed development, the crop is more likely to encounter heat and moisture stress during critical growing stages. Planting delays do not appear to result in a reduction of final planted area for barley, but rather farmers simply continue to plant beyond the optimum “window,” which likely accounts for the typically lower yields. The price of feed barley in Ukraine has increased by about 25 percent since early March and currently exceeds the prices of feed wheat and milling wheat.

Persistent dryness during March and April depleted surface moisture in some regions -- particularly central and south-central Ukraine -- and likely hampered the establishment of spring grains. Showers in early May provided much-needed relief and improved surface moisture conditions, but (as in the case of winter crops) spring-grain yields will hinge largely on May precipitation.

Slight Increase in Estimated Corn Output

Most farmers and local analysts interviewed by the team in April were forecasting that corn area for 2007 will remain relatively stable from last year despite the high world prices driven by U.S. demand for ethanol, and the Ministry of Agriculture currently forecasts that planted area will be roughly the same as last year. The USDA estimates Ukraine corn production for 2007/08 at 7.0 million tons, up 0.6 million from last year, and harvested area at 1.8 million hectares, up 0.1 million from last year. Although yield dipped slightly in 2006/07 –chiefly the result of excessive August heat – improved technology for corn production has contributed to a steady and significant increase in yield since 1999.

Agricultural Machinery: Lower Inventories, Higher Efficiency

According to data from the State Statistical Committee of Ukraine, inventories of agricultural machinery on agricultural enterprises (which account for about 80 percent of grain production) have been decreasing steadily for over 15 years. Between 2000 and 2005, the fleet of tractors and grain harvesters dropped by about 30 percent and the number of corn harvesters by 40 percent. The steady decline in the machinery inventories has increased the service demands of each unit. For example, the ratio of corn hectares per harvester more than doubled since 2000.

Meanwhile, the area of winter wheat has essentially remained stable since 1996 (year-to-year fluctuations notwithstanding), and the area for both barley and corn has increased. Furthermore, yields for all major crops are higher than five years ago. The increase in area and yield despite fewer machines can be attributed in large part to the replacement of deteriorating Soviet-era equipment with new, more efficient machinery, particularly imported combines. The amount of cropland under the management of large agricultural enterprises is steadily growing, and many of these enterprises have the financial resources to purchase or lease new equipment. Also, decreasing leasing costs have made it more affordable for farms to lease new machinery. The greater efficiency of new equipment (even domestically-produced machinery) compensates for the lower number of units. Analysts estimate that the use of imported (chiefly U.S.) combines can reduce harvest losses by at least 20 percent.

Certified Seed Boosts Yields

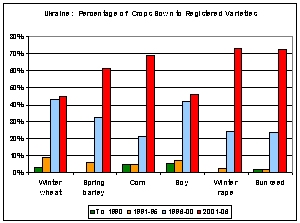

In the years immediately following the breakup of the Soviet Union – and the loss of massive State subsidies to the agricultural sector – farmers almost exclusively used “common” seed (seed saved from the previous year’s harvest) for planting. Since that time, the use of certified seed has grown enormously, especially on the larger agricultural enterprises; many smaller farms in Ukraine are unable to afford certified seed. The State Statistical Committee does not publish comprehensive data detailing the use of certified seed, but official data on the use of registered varieties in Ukraine serve as a fairly reliable indicator of the jump in certified seed use, according to specialists at the Hydromet Center. In the years immediately following the breakup of the Soviet Union – and the loss of massive State subsidies to the agricultural sector – farmers almost exclusively used “common” seed (seed saved from the previous year’s harvest) for planting. Since that time, the use of certified seed has grown enormously, especially on the larger agricultural enterprises; many smaller farms in Ukraine are unable to afford certified seed. The State Statistical Committee does not publish comprehensive data detailing the use of certified seed, but official data on the use of registered varieties in Ukraine serve as a fairly reliable indicator of the jump in certified seed use, according to specialists at the Hydromet Center.

Other estimates as well indicate improvement in planting-seed quality. According to a senior researcher at the Wheat Institute in Odessa, about 80 percent of the grain and oilseed fields on Ukraine’s larger and more profitable enterprises are sown with certified seed. Although the overall share of certified-seed use throughout the country is certainly lower than 80 percent, all commodity analysts agree that the considerable growth in the use of certified seed has contributed to an increase in the yields of major crops in recent years. The yields for corn and sunflowerseed especially have benefited from improved technology. Unofficial estimates indicate that roughly 65 percent of corn and sunflowerseed are planted with certified seed (including hybrids), compared to about 40 percent for wheat.

The use of elite seed for barley is growing, and currently exceeds the rate for wheat; farmers are less willing to invest in certified seed for wheat because of the smaller profit margin. (This observation is supported by the official data on the use of registered varieties.) Compared to two years ago, the share of elite and super-elite seed has increased by about 35 percent for grains, sunflowerseed, and soybeans, and by 40 to 45 percent for corn.

The government of Ukraine ostensibly subsidizes the use of certified seed by paying the difference in cost between certified and non-certified, but farmers must use all certified seed in order to qualify for the subsidy. As a result, many farmers that cannot afford to use anything other than common seed cannot take advantage of the subsidy. Several local farmers and commodity analysts offered this stipulation as evidence that State programs are aimed to benefit larger farms.

Lower Yields on the Smaller Enterprises

One of the most consistent themes raised by farmers, local agricultural officials, and independent commodity analysts is the lower crop yields and lower profitability of small agricultural enterprises. (Agricultural enterprises are farms that produce crops, livestock products, or other agricultural output chiefly for sale rather than for subsistence. They account for about 75 percent of Ukraine’s grain production and 80 percent of the sunflowerseed and sugar beet production.) According to the State Statistical Committee, there were about 50,500 agricultural enterprises in Ukraine in 2005. About 35,400 of these farms, or 70 percent, were less than 250 hectares in size, and together they accounted for only 9 percent of the total area cultivated by agricultural enterprises. About 43,000 agricultural enterprises were engaged in grain production in 2005. Just over 75 percent were smaller than 250 hectares, and these farms accounted for less than 20 percent of total grain output from agricultural enterprises in 2005. Total grain yield on the smaller farms (i.e., smaller than 250 hectares) was 1.80 tons per hectare, while yield on the larger farms was 2.72 tons per hectare.

Observers attribute the lower profitability of small farms to several factors, most stemming from difficulty in obtaining credit. Theoretically, credit is available to all farmers, but loans are subject to conditions that many cash-strapped small farms are unable to meet. For example, farmers typically must purchase crop insurance offered by the bank through private insurance companies. This insurance can be prohibitively expensive for many farmers. Small farms’ difficulty in securing large, long-term loans makes it difficult for them to purchase new machinery that would improve efficiency and reduce harvest losses. Many specialists indicate that State policy favors large enterprises over small farms. Agricultural subsidies are attached to cumbersome stipulations that can essentially exclude participation by small farmers. (Note the previous example of the certified-seed program.)

Many small farms (but not all) are single-family operations comprised of the combined shares distributed to the individual family members upon the dismantling of Ukraine’s State and collective farms in 1991. Share size varies depending on the area and work force of the collective farm. Although a single-family farm greater than 100 hectares in size would not be unusual, over 28,000 of Ukraine’s agricultural enterprises (57 percent) are smaller than 50 hectares.

Some analysts suggest that two options are available for unprofitable small farms:

- Farmers can rent their land to larger enterprises. This is what the overwhelming majority of shareholders elect to do.

- Small farms can focus on niche products, like strawberries or elite planting seed.

Specialists agree that the overall efficiency of Ukrainian agriculture will improve as the unprofitable farms fail and are absorbed by more successful enterprises. This will result in an increase in the amount of land under the management of enterprises that can afford certified seed, modern equipment, and other technology. Official data support this observation: since 2000, profitable farms have outnumbered unprofitable farms, and yields for most crops have been increasing.

Grain Export Quotas

In October of 2006, the government of Ukraine imposed quotas prohibiting exports of wheat, barley, and corn without a government-issued license. The official reason for the quotas was to ensure price stability and food security. Virtually all of the farmers and commodity analysts interviewed by the team questioned the need for export quotas on barley and corn; most agreed that the main beneficiaries were poultry producers, who saw a reduction in feed-grain prices. In the case of wheat, however, the justifications were reasonably legitimate. Exports were indeed high and there was a genuine concern regarding insufficient supplies of milling quality wheat, but the government’s clumsy initial attempt to replenish the country’s strategic grain reserves prior to invoking the quotas did little to solve the problem. In order to restore State grain stocks, the government demanded that grain trading companies sell grain to the State at prices that the traders considered unreasonably low. When the traders refused to sell, the government imposed quotas (in three stages, between October and February) setting total export limits at 0.6 million tons for wheat, 1.4 million for barley, and 0.5 million for corn.

The quotas posed enormous and costly problems for grain exporters. Companies were unable to fulfill existing contracts and in addition to the loss of income were forced to pay penalties on the unfulfilled contracts. Furthermore, exporters were obligated to pay demurrage (storage) charges on undelivered grain that was rapidly spoiling in port storage facilities because of sprout and bug damage. The Ukraine Grain Association estimates that demurrage charges and penalties on unfulfilled contracts have amounted to $100 million for traders. The U.S. agricultural attaché in Kiev estimates total market losses to date at $200 million, and the World Bank estimates losses even higher, at $300 million. Farmers were generally unaffected by the wheat and barley quotas because they had already sold their grain to traders, but the corn harvest was still in progress when the corn quota was invoked. Although farmers were barred immediate access to the export market, most medium- and large-sized enterprises have adequate facilities for long-term storage of corn, and domestic prices for corn have been relatively high. The quotas posed enormous and costly problems for grain exporters. Companies were unable to fulfill existing contracts and in addition to the loss of income were forced to pay penalties on the unfulfilled contracts. Furthermore, exporters were obligated to pay demurrage (storage) charges on undelivered grain that was rapidly spoiling in port storage facilities because of sprout and bug damage. The Ukraine Grain Association estimates that demurrage charges and penalties on unfulfilled contracts have amounted to $100 million for traders. The U.S. agricultural attaché in Kiev estimates total market losses to date at $200 million, and the World Bank estimates losses even higher, at $300 million. Farmers were generally unaffected by the wheat and barley quotas because they had already sold their grain to traders, but the corn harvest was still in progress when the corn quota was invoked. Although farmers were barred immediate access to the export market, most medium- and large-sized enterprises have adequate facilities for long-term storage of corn, and domestic prices for corn have been relatively high.

The license requirements for barley and corn exports were lifted in February 2007, and local observers are confident that they will not be reinstated. The wheat quota, meanwhile, remains in place but is required by law to be lifted no later than June 30. Most commodity analysts suggest that wheat export quotas are unlikely to be reinstated, but, in the opinion of one leading analyst, wheat has become a political crop and the situation remains unpredictable. (For more information on the export quotas, see the Ukraine Grain and Feed Annual, March 2007.)

Current USDA area and production estimates for grains and other agricultural commodities are available on PECAD’s Agricultural Production page, or at PSD Online.

|