Ukraine: Sown Area for 2016/17 Wheat Likely to Drop by 15 Percent

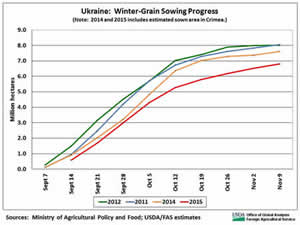

Severe dryness has sharply reduced the planted area of 2016/17 winter wheat in Ukraine. With fall sowing essentially finished, the planted area as of November 17, 2015,was reported by the Ministry of Agricultural Policy and Food at 5.6 million hectares (not including an additional 0.3 million in Crimea), reaching only 90 percent of the official forecast and down 13 percent from the same date last year. The shortfall was most apparent in the steppe zone, which typically accounts for over half of the country’s wheat area. Because of the resiliency of winter wheat and the dominant role of spring weather, however, it would be premature to forecast a significant drop in yield based on current conditions. Ukraine’s 2015/16 wheat crop was also subject to considerable fall dryness but conditions rebounded following generous spring precipitation, and the final yield reached a near-record level.

Planted Area Planted Area

According to daily data from the Ministry of Agricultural Policy and Food, the planting of Ukraine’s other winter crops is largely complete as well. As of November 17, winter barley area was down 18 percent from last year and 14 percent below the official forecast, rye was down 3 percent from last year and 8 percent below the forecast, and rapeseed was down 27 percent from last year and 21 percent below the forecast. Virtually all of Ukraine’s rye and rapeseed are winter crops, but winter barley typically accounts for only 30 to 40 percent of the country’s total barley area. Spring barley planting begins in March and concludes by the end of April. Final area from the State Statistical Committee will be released in December, and numbers from the two agencies tend to be fairly consistent.

Establishment Conditions

Eastern and southern Ukraine received minimal precipitation from the beginning of September through the first week of November. The dryness extended throughout the planting season and hampered the emergence and establishment of winter crops. Microwave satellite imagery indicates that surface wetness was below normal in September and the dryness intensified during October. The dryness was most severe in nine territories in eastern Ukraine that together produce about half of the country’s wheat. Surface moisture throughout the country was finally replenished during the second week of November, but subsurface moisture remains low in many territories.

Satellite-derived vegetative indices (the normalized difference vegetation index, or NDVI) reflect the impact of the drought on winter-crop establishment. According to the NDVI, crop conditions as of November 8 were substantially below normal in eastern and southern Ukraine. Conditions are worse than last year, which was also marked by dry weather and unfavorable establishment conditions for winter crops. Winter wheat was still in the tillering stage in most of the main winter-wheat zone as of mid-November, and local specialists report that conditions are poor as fall vegetative growth winds down prior to the crops entering dormancy. According to the Hydromet Center of Ukraine, there is a strong likelihood that only 25 to 40 percent of winter crops will achieve optimal conditions for over-wintering , and as much as 15 percent of the sown area may fail to emerge. Weather-related losses during the fall and winter are another factor contributing to final winter wheat output. A relatively small share of the fall-sown winter crop area (typically not much more than 6 percent) fails to survive due mainly to fall drought, winter frost, or both. Losses for 2016/17 will not be determined until after vegetative growth of the surviving crops resumes in the spring.

Winter-wheat yield depends to a great extent on spring weather, and two recent examples illustrate the difficulty of forecasting yield with any degree of confidence at this stage of development. Fall establishment conditions for the 2012/13 wheat crop were arguably as poor as for the current season, and yield prospects improved only marginally following below-normal precipitation in the spring. Final yield was reported at 2.80 tons per hectare, not a disaster by any means, but 8 percent below the average of the previous five years. In contrast, abundant spring rainfall in 2015 offset severe autumn dryness, replenishing soil-moisture reserves and driving 2015/16 wheat yield to a near-record level.

Spring Crop Options

Preliminary fall-planting data indicate that total winter-crop area for 2016/17 will decrease by at least 1.6 million hectares. Assuming that an additional 0.4 million hectares of the planted winter crops will not survive (a conservative estimate based on historical data), the area available for the planting of spring crops will increase by at least 2.0 million hectares from last year’s level.

Spring wheat and spring barley would appear to be unpopular options for reseeding. For the past three years, Ukraine spring wheat area has barely surpassed 150,000 hectares (about 2.5 percent of total wheat area), and given the variety of other, more profitable spring crop options it seems unlikely that spring wheat area will significantly increase this year. The area sown to spring barley, which traditionally was the most popular crop for the reseeding of fields subject to winterkill, has been decreasing steadily for six years irrespective of the amount of winter losses. Sunflower seed is a consistently popular and highly profitable crop, but farmers face rotational constraints. Specialists in Ukraine recommend that sunflowers not be planted in the same field more than once every seven years, and USDA estimates that sunflower area has remained remarkably stable – between 5.3 and 5.5 million hectares – for the past six years.

Corn area peaked at 4.8 million hectares in 2013 and decreased slightly in 2014, to 4.6 million hectares. Data from the State Statistical Committee indicate that the profitability of corn is similar to soy, and the cost of production on a per-ton basis is considerably lower. But in terms of per-hectare up-front costs, the cost of production for corn is the highest of all major crops in Ukraine. According to a June report from the U.S. agricultural attache in Kyiv, a sharp increase in the cost of inputs, including seed, fertilizer, and chemicals, contributed to a reduction in corn area for 2015/16 to an estimated 4.0 million hectares. Meanwhile, soybean area continues to skyrocket. While corn area decreased by 13 percent from last year’s level, the estimated 2015/16 soybean area increased to 2.1 million hectares, up nearly 20 percent from last year and double the level of only five years ago. Although the planting of genetically modified seed is officially prohibited in Ukraine, soybean producers routinely ignore the ban. Moreover, farmers maintain that they can plant “saved seed” (seed reserved from the previous year’s harvest) for up to five years with no significant decrease in yield, which enables farmers to reduce the cost of production. Private analysts estimate that 50 to 70 percent of Ukraine’s soybeans are grown from genetically modified seed.

The valuable contribution of Denys Sobolev, agricultural specialist at the USDA Office of Agricultural Affairs in Kyiv, is gratefully acknowledged. Current USDA area and production estimates for grains and other agricultural commodities are available at PSD Online. Initial USDA estimates of 2016/17 crop production will be published on May 10, 2016.

Visit Crop Explorer http://www.pecad.fas.usda.gov/cropexplorer/

|